It’s impossible for a government to talk about industrial strategy in the UK without mentioning British Leyland, the auto conglomerate effectively nationalised after going bankrupt in 1975, and which finally expired in 2007. As everyone knows British Leyland illustrates the folly of governments “picking winners”, which inevitably produces outcomes like cars with square steering wheels. So it’s not surprising that the government’s latest discussion document Green Paper: Building our Industrial Strategy begins with a disclaimer – this isn’t a 1970’s industrial strategy, but a new vision, a modern industrial strategy that doesn’t repeat the mistakes of the past.

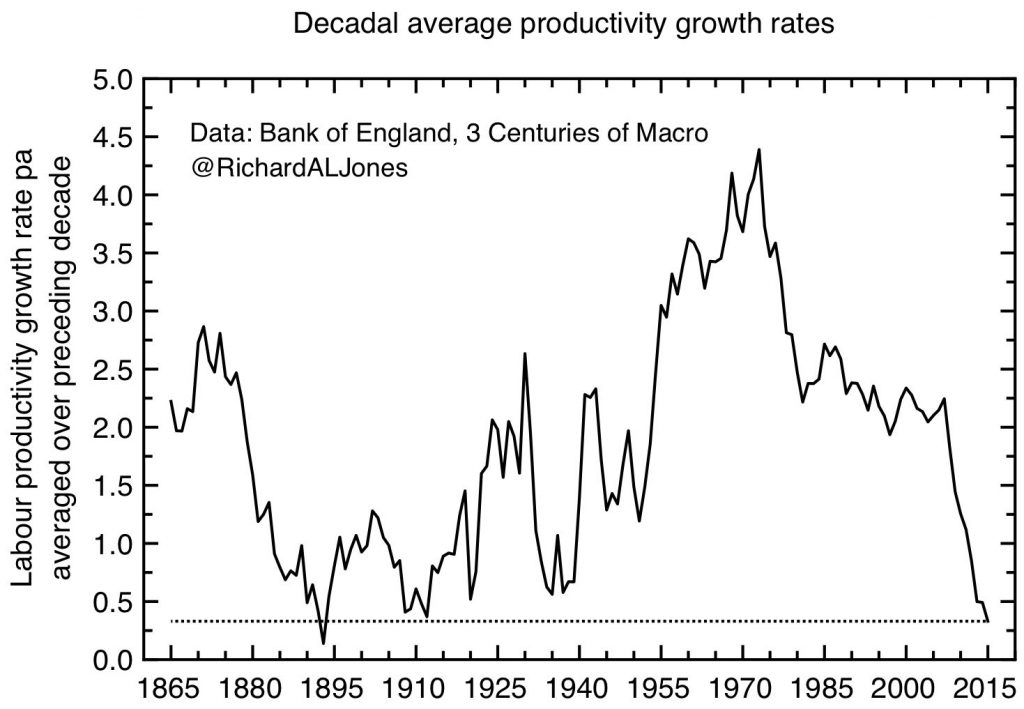

The document isn’t actually a strategy yet, and it’s a stretch to describe much of it as new. But it is welcome, nonetheless; its analysis of the UK economy’s current position is much more candid and clear-sighted about its problems than previous government documents have felt able to be. Above all, the document focuses on the UK’s lamentable recent productivity performance (illustrated in the graph below), and the huge disparities between the performances of the UK’s different regional economies. It puts science and innovation as the first “pillar” of the strategy, and doesn’t pull punches about the current low levels of both government and private sector support for research.

UK Productivity has grown less over the last ten years than over any previous decade since the late 19th century. Decadal average labour productivity growth, data from Thomas, R and Dimsdale, N (2016) “Three Centuries of Data – Version 2.3”, Bank of England

UK Productivity has grown less over the last ten years than over any previous decade since the late 19th century. Decadal average labour productivity growth, data from Thomas, R and Dimsdale, N (2016) “Three Centuries of Data – Version 2.3”, Bank of England

It is a consultation document, and unlike many such, the questions don’t give the impression that the answer is already known – it does read as a genuine invitation to contribute to policy development. And what is very welcome indeed are the strong signals of high level political support: the document was launched by the Prime Minister, as “a critical part of our plan for post-Brexit Britain”, and as an exemplar of a new, active approach to government. This is in very sharp contrast to the signals coming out of the previous Conservative government.

How should we judge the success of any industrial strategy? Again, the strategy is admirably clear about how it should be judged – the Secretary of State states the objective as being “to improve living standards and economic growth by increasing productivity and driving growth across the whole country.”

I agree with this. There’s a corollary, though. Our existing situation – stagnant productivity growth, gross regional disparities in prosperity – tells us this – whatever we’ve been doing up to now, it hasn’t worked.

Industrial strategy over the decades

This is where it becomes important to look at what’s proposed in the light of what’s gone before. Why? Because, although the words “industrial strategy” come in and out of fashion, and we’ve seen productivity plans, industrial policies and innovation frameworks, the conceptual underpinnings have remained remarkably stable, with a strong emphasis on the idea of correcting market failure. As a result the policy approaches have had a great deal of continuity.

Going back to the beginning of this parliament, we had “The productivity plan: fixing the foundations, creating a more prosperous nation” – – from the Treasury in July 2015, in which long term investment in science and innovation, skills and infrastructure would lead to a dynamic economy.

In the previous, Coalition government, we had an Industrial Strategy – “a long-term, whole of government approach to support economic growth”, focused on skills, technologies, finance, government procurement, and sector support. This credit card size explanation from 2013 – Industrial Strategy Explained – gave a handy reminder of the 8 great technologies and 11 key sectors.

In many ways, the Coalition’s approach was a continuation of that begun by Peter Mandelson, whose April 2009 document New Industry New Jobs – marked his post-financial crash conversion to interventionist government. “We must improve the skills of our people and adapt them to the specialist demands of a modern economy; strengthen our capabilities in research and development; innovate further in science and technology, and industrialise this innovation in commercially successful ways”

But even through the discontinuity imposed by the financial crisis, many of these themes are familiar from the important New Labour document, “Science and Innovation Framework 2004 – 2014”, associated with Lord Sainsbury. This comprehensive and carefully thought through document had already identified one of the key weaknesses in the UK’s innovation system – low levels of business R&D compared to competitor nations. That policy framework was brave enough to set a numerical target – to increase business R&D intensity from 1.25% of GDP to 1.7% over the decade.

Between 2004 and 2014, business R&D intensity more or less flatlined, and now, in 2017, the Industrial Strategy Green Paper reports that “Business investment in R&D (BERD) is just over one per cent of GDP in the UK, close to half the rate in Germany and substantially below the OECD average”. Whatever we’ve been doing up to now, it hasn’t worked.

Old and new in the Industrial Strategy Green Paper

So what elements in the industrial strategy Green paper are new, and which reprise the traditional approaches?

Among the familiar themes, we have science and innovation support, including knowledge transfer, IP exploitation and tax credits, skills

infrastructure, government procurement, and trade and inward investment. In a return to the Mandelson/Cable tradition, support for individual sectors, like aerospace and automobiles, is specified. The question to ask here is, what will be done differently to ensure that these measures make a material contribution to the goals of the strategy – increased productivity and economic growth more spread across the economy?

To be fair, we should look carefully for measures that have worked locally, even though their impact on the whole economy may not have been enough to counter the other headwinds its faced. Arguably, the revival of the auto industry can be read in these terms. This was very much a focus of the Mandelson/Cable era. Its success can be measured in overall growth of sales and exports; business R&D in this sector has also increased substantially, by 80% since 2008. One might expect this to have a positive effect driving innovation throughout parts of the economy touched by this sector. Overall, this looks like a success for industrial strategy, and it should be studied for wider lessons.

Many other measures may well have been sensible interventions, that in the past have simply not been done on a large enough scale to have a material effect on the whole economy. For example, over the last decade or so InnovateUK (previously the Technology Strategy Board) has found its feet as an agency for providing government support for industry-led innovation. But in comparison to similar agencies in other countries, many argue that it is simply too small.

But here, the question we need to ask is about the absorptive capacity of our innovation system. If we were to double InnovateUK’s funding, would we find enough UK business to lead and participate in it, given the overall low levels of UK business R&D?

DARPA envy

Where there has been a very substantial increase in government funding has been through the vehicle of the Autumn statement’s “Industrial Strategy Challenge Fund”. By 2020, this is planned to reach £2 billion a year in scale – more than twice the size of the current largest existing research council. It’s not currently obvious how this money will be spent.

One model that government looks at with interest is the US defense research agency DARPA, which has a very high reputation for producing some of today’s defining technologies, such as GPS and the Internet. Is the DARPA model transferrable? Its stated goal is to produce transformational change, not the incremental developments that are characteristic of much applied research. But it is firmly challenge-led, rather than being defined by the priorities of any one scientific discipline.

Its success owes much to the very high calibre programme managers, who are intimately involved in the projects at a technical level, and have a considerable degree of discretion in shaping projects midstream (or, indeed, terminating them, if they aren’t going anywhere). To replicate this, the UK government is going to have get past its ingrained view that the people who work for research councils are back-office bureaucrats devoted to red-tape, whose numbers should be relentlessly pushed down. Instead, the high quality people in those roles need to be appreciated for their essential contribution to the success and cost-effectiveness of the projects they are responsible for.

But above all, DARPA is very clear about what its mission is – it is to ensure the US military maintains overwhelming technological superiority over any rival. That clarity of mission makes it clear how the challenges it sets are to be defined. The Industrial Strategy Challenge Fund needs to be just as clear about its mission, and needs to have a systematic process for setting its challenges. This needs to go beyond the traditional BOGSAT* methodology; it will take time, money, technical expertise and a diversity of viewpoints, as well as a very clear steer about the strategic goals.

Spin-outs and scale-ups

The issue of scale applies also to venture capital. It’s a widespread complaint that the UK venture capital industry is too small, and funding isn’t available to start and grow innovative new companies. In 2015, VC industry invested £321m in technology companies at early stage and expansion, having raised £286m in funds from government sources (including the EU). The question to ask here is, if the sums available for VC investment were much larger (perhaps through even greater direct support from government), would there be the investment opportunities available to absorb it? Are we limited here by money, or ideas (by which I mean investable ideas, with a low enough level of technical risk and a well-developed market plan)?

Is it the universities’s fault that there are not more dynamic spin-out companies being produced? UK universities are much blamed for their performance in this front, being accused alternately of over-valuing their IP, and demanding too much in return for it in terms of cash or equity stakes, or of undervaluing it and not making strenuous enough efforts to commercialise it. In fact, UK universities produce about the same number of spin-out companies as the US per unit of funding, so it’s difficult to argue they are doing this too badly at the moment. Could we improve on how IP is handled by Universities? I’m sure we could, and “identifying and spreading best practise” among universities’ technical transfer office is always worth doing, but I doubt whether this will make an order-of-magnitude difference, and our obsession with the issue distracts from more pressing problems.

There are some other familiar measures that frequently get talked about, but about which, in the recent past, not much has actually been done. The shortage of mid-level technical skills in the UK is, of course, an evergreen subject (first considered by the 1887 Royal Commission on Technical Instruction), but it remains an important problem, so it is welcome that concrete measures are proposed here, in the form of a new set of “Institutes of Technology”. The initiative is welcome, but I think it would be a mistake to consider this in isolation. In particular, FE, business and Universities can and should work together on intermediate level skills. The new Institutes of Technology would benefit from explicit links with universities, to help develop “parity of esteem” between technical and higher education, to create new routes into higher education to widen access, and to emphasise the link between training and innovation.

Finally, every document on the government’s role in innovation will, inevitably, talk about government procurement as a way of driving innovation, but the many barriers to this working seem difficult to overcome. Healthcare is the prime example – on the one hand, the NHS spends more than £100 billion a year, on the other, it faces massive cost pressures that surely innovation and technology could help to relieve. And yet the organisation of the NHS seems to be inimical to innovators – and its recent reorganisations have probably made this worse.

Low carbon energy

The green paper does bring in some and important new elements. Remaining with the theme of the way government can use procurement to push along the new technologies it needs to meet its strategic goals, the inclusion of “Delivering affordable energy and clean growth” as one of the pillars of the strategy is enormously welcome. I welcomed the merger of the Department of Energy and Climate Change with the Department of Business, Innovation and Skills, because I thought it would give the opportunity of aligning the government’s (correct and admirable) goals on climate change with the development of industrial strategy. Developing clean, affordable sources of renewable energy must be a strategic priority for this government and governments to come, and new technologies must be developed in a way that both allows the UK to meet climate targets at an affordable cost, and which develops UK industry.

However, we need to be self-critical about the mistakes of the past in this area, and I would single out the Nuclear New Build policy of recent governments as an industrial strategy disaster, with a programme that might as well have been designed specifically to maximise the cost to energy consumers, while minimising the benefits to UK industry (and to be fair, I think all three major political parties share responsibility for this state of affairs). In order to ensure that the capital cost of nuclear new-build is kept off the government’s balance sheet and to maintain the fiction that nuclear will not receive subsidies, complex financing arrangements based on long-term revenue guarantees from the government have been put in place, which both increase the expense to consumers and relinquish control over where the money is spent. Meanwhile every new nuclear plant is being built to a different design by a different (overseas based) supplier, making it much more difficult to establish UK based supply chains which can drive down costs through learning by doing. The recent encouraging government noises about small modular nuclear reactors represent a belated recognition that the current approach has been sub-optimal.

The Green Paper doesn’t mention solar energy at all, despite the unexpectedly rapid uptake of solar energy in the UK, and the very significant strength in the academic base in new solar technologies, such as the perovskite systems discovered by Henry Snaith at Oxford. But it is clear that batteries will become much more important in an energy system relying on more intermittent renewable energy, such as wind, and are vital for decarbonising transport through electric vehicles.

So the initiative the Green Paper announces – “we will review the case for a new research institution to act as a focal point for work on battery technology, energy storage and grid technology, reporting in early 2017” – is not a bad idea. But it will need to be done carefully – to have an impact on the economy, it would need to be avowedly translational, and its design will need to reflect a very good understanding of what is a very competitive international landscape. It would need to focus on areas where there is some chance that the UK can take value from what will be a complex international supply chain.

For example, in batteries for electric cars, the UK has a committed customer in JLR, but the UK not yet strong in battery manufacture. This can be a brutal business – the MIT spin-out A123 is a cautionary tale, which despite excellent new technology and very substantial funding both from venture capitalists and the US government, went bankrupt, its assets and intellectual property ending up being bought by a Chinese company. Perhaps there is something to be learnt from Tesla’s experience of partnering with an existing battery manufacturer – Panasonic – and adding value through systems engineering.

The long tails in firm performance

There seems to be a growing gulf between the productivity performance of those leading companies at the technological frontier and a long-tail of under-performers, and closing that gap would be a significant contribution to raising the productivity average. Here the focus needs to be on diffusion of existing best practise as much as innovation at the technological frontier, and its worth thinking hard about what institutions can contribute to this.

I’m surprised at how little Catapult Centres are mentioned in the document, as they were one of the main new instruments of industrial policy in the Coalition government, with cross-party support. However, where they do get a mention is in their role as hubs of clusters and innovation districts. This is certainly how the Sheffield branch of the High Value Manufacturing Catapult at the Advanced Manufacturing Research Centre operates, as a strongly translational engineering R&D centre which drives innovation and skills in a very wide range of partner companies, from large multinationals to local SMEs. Inward investment by international companies on the technological frontier can contribute to raising innovation and skills levels throughout a local or regional cluster, and this ought to be an explicit aim of national and local government support of inward investment.

Disparities in economic performance across the UK’s regions

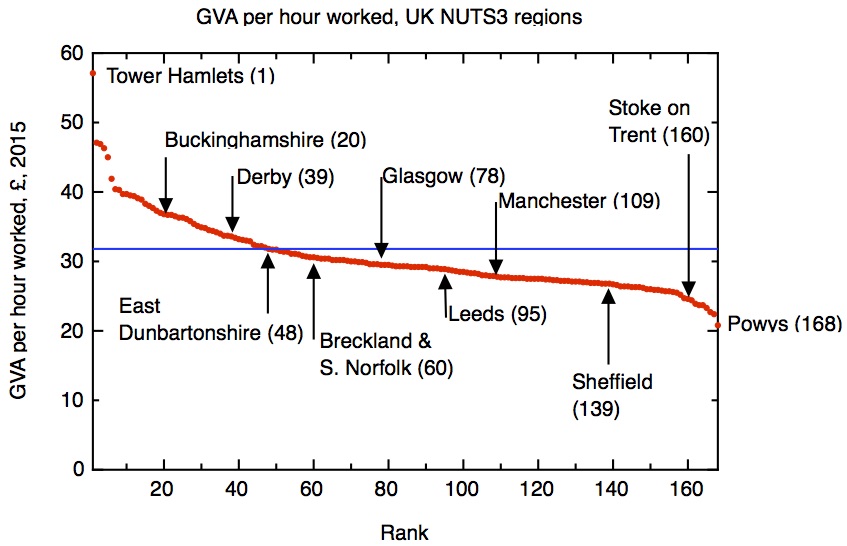

The other very welcome new ingredient in the green paper is a long-overdue emphasis on the gross regional disparities in economic performance across the UK. The dominance of London and its sphere of influence in the South-East mean that most of the country is below average economically – as shown in the graph below – and the importance of the “left-behind” regions politically has become all too apparent in the Brexit vote.

Regional variations in productivity across the UK, by NUTS 3 regions. Nominal smoothed GVA per hour worked, 2015. Data: ONS Regional and Subregional Productivity January 2017 release.

One can look at this issue from two ends. Why are the “left-behind” regions doing so badly? Here we should remember that the poorest parts of the UK don’t just include de-industrialised regions like Barnsley and Merthyr Tydfil, but the rural periphery, like Anglesey and Cornwall.

Alternatively, one can ask if there are any particular policies which (intentionally or not) have helped the richest areas to grow even more. There has, in effect, been an industrial policy to support the financial services sector, through infrastructure (the Jubilee line extension can be thought of as industrial policy in support of financial services, as David Willetts pointed out). And, of course, in the 2000’s version of industrial strategy it wasn’t a failing car company that were bailed out and nationalised, but our banks.

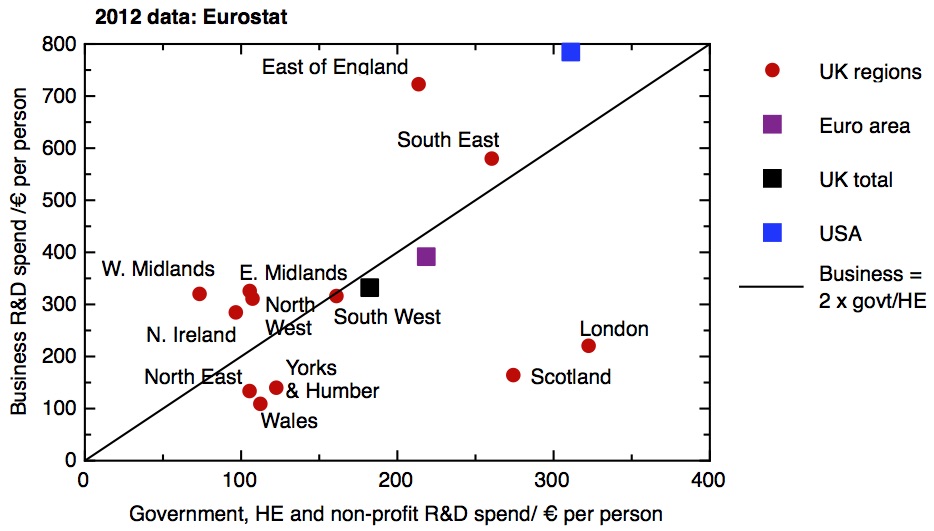

One very striking difference between the prosperous parts of the UK and the less prosperous parts, which the Green Paper does draw attention to, is the degree of R&D spending they receive, both from private sector and public sector sources. The dominance of London in public sector R&D is very striking, as is its relatively small degree of private sector funding brought in to follow that. This is an issue in which strategy is essential, in the sense that every decision that exacerbates this imbalance can be individually justified. For example, a £250 million national research centre for Dementia, to be hosted at UCL, was recently announced. On scientific grounds this decision can’t be faulted – UCL’s research capacity in neuroscience is outstanding and unrivalled, yet once again it adds to an overall already very unbalanced national landscape in biomedical science. So correcting these imbalances will need a long-term deliberate strategy.

Business and government/higher education R&D in the UK by NUTS 2 regions. Data: Eurostat, updated 31.03.16

Incumbents and disruptors

The green paper stresses the importance of supporting disruptive future companies as well as incumbents. This is easy to agree with in principle, but surprisingly difficult to put into practise – how does one tell which small companies are likely to grow and prosper? Blanket support for all small companies and entrepreneurs will dilute the support for companies with real potential amongst the majority of small companies that are destined to stay small – what Paul Nightingale calls “marginal undersized poor performance enterprises” (muppets).

Moreover, incumbent companies always have the advantage when policies are being formed – it’s easy to get the incumbent industry leaders in a room, but who will represent the companies yet to be born, the technologies yet to be developed?

Practical measures would increase the flow of VC fundable companies by addressing the problem of limited good ideas. By “good ideas”, I mean here ideas that have been rigorously tested, and their degree of technical risk decreased by systematic translational research to a level at which VCs are prepared to put money into them. There is a role here for translational research centres, and in areas where the aspiration is to transfer new technology through spin-out companies this should be designed in as a key objective.

The approach to industrial strategy which emphasises sectors, while having many virtues, does very much favour incumbents. Sector approaches reward the well organised (aerospace, for example, having been a leading beneficiary of British industrial strategy for decades). Conversely the chemicals industry is an interesting absence from industrial strategy, despite its large scale, R&D intensity and potential for productivity growth. Chemicals contribute £8.8bn to UK GVA, comparable to auto (£13.6bn), aerospace (£9.4bn) and pharma (£6.4 bn), and I can only attribute its low visibility to poor organisation. Other areas by their nature have much less tendency to self-organise; the creative sector is a notable and important example, and it’s good that the Green Paper singles this out.

The UK’s new business model

Fundamentally, an industrial strategy needs to answer the question – how is the country going to make a living? More modishly, one can express this as the need for the UK to articulate its business model and then mobilise resources to support that.

There can be no more timely moment to do this than now, as the UK enters the process of tearing up its current trading arrangements, in ways which will undoubtedly cause big shifts in the patterns of comparative advantage across the economy. We hear lots of rhetoric about the UK as a great trading nation, but trading nations have to have something to sell. The UK is a service based economy, but as trade barriers across the world go up services will be even more difficult to trade internationally than they currently are.

So if the UK is going to trade its way to success post-Brexit, it’s going to need to decide in what sectors, what kinds of products and services, it has the potential to be competitive and innovative in. We need to recognise that in many areas our capacity to innovate isn’t as big as it should be, and the government needs to use all the tools it has to improve that capacity, focusing not just on the supply side but on the demand for innovation too. Some of the fundamental assumptions that governments have been making for twenty years or more will need to be revisited, because whatever we’ve been doing up to now hasn’t worked.

*BOGSAT: bunch of guys sat at a table

Updated to include graphs, 5 Feb 2017. NHS budget corrected, 9 Feb 2017

Hi Richard,

What is fascinating is that most of our problems is in the software sphere! Where are our Googles / Twitters / Ubers etc… Why is it that China of all places are the only other place where Software get’s done???

It appears that huge scales are required in Software which the UK does not have especially since we have left the EU. Basically the UK is made up of specialised small companies like Deepmind which are swallowed by American big fish.

Therefore, we require Challenger Banks, Fintech solution to pick winners for the UK.

What then is the point of Industrial policy? IMHO it is to follow China and do whatever we can to disrupt the existing UK Finanicial Model with new hungry players!

Just recently, I read about Uber’s adventures in China and how it is losing 1 Billion Dollars per annum in China in a war for market share. This might seem like folly, but these guys built Uber!

Do we have Entrepreneurs who can get past profit and loss and embrace the Bucaneering spirits.

Thankyou Richard for you interesting Blog!

Zelah

Thanks for the additional graphs. I am fascinated by the regional differences. Any thoughts why Derby sits so much higher than Leeds or Sheffield? Is this to do with Bombardier? And what is the cause of the success of Brecklands and South Norfolk? I can’t immediately mentally identify large, productive employers around Thetford. Finally, I guess it is unsurprising that the East of England has managed to attract so much business investment around the ‘Cambridge cluster’ and its environs, but I note it still falls short of the USA average. Your point about lack of business investment in London is very interesting as I suspect most people would have assumed the opposite.

Zelah, the UK has produced some successful software companies (Autonomy is one that comes to mind) but as you say they tend to be sold (Autonomy, to subsequent controversy, to HP). DeepMind (though small) is the most recent example, though people tell me it is one example of a genuine competitive advantage the UK has in machine learning. I suspect you’re right about scale – the size of the market in the USA – and now China – does give a big advantage when trying to scale up. I don’t think I’m as enthusiastic as you about fintech as the solution, though; I suspect a lot of fintech’s apparent advantage over existing operations is in exploiting loopholes in regulation.

Athene, of course one would have to go into much more detail about the composition of local economies to understand these differences properly. Derby did surprise me when I first looked at the figures – it really is much more productive than nearby Nottingham, for example. My guess is that this arises because it is a relatively small city dominated by some very high value manufacturing operations – Bombardier, as you say, but also Rolls-Royce. I don’t know about Norfolk – but it is worth remembering that UK arable farming, in its heartlands from East Anglia through Lincolnshire to E. Yorkshire, is itself very productive. But you’d have to look into the numbers in more detail.

A short comment on the UK VC scene.

Whilst in theory your comments on “supply of good ideas” seem instinctively correct, the reality of the UK VC scene is that (partly because it is so small) it is incredibly risk averse (esp. when compared to the USA.) Part of the reality in software is that anyone in the industry can name 5 good ideas that had to go to the USA to get funded. One could attempt to change the culture of UK VC, but it is probably more realistic to work on the size and let the increase in supply start to address some of these problems.

Thanks for a great blog. I had one point I wondered if you had any further thoughts on.

As you were, I was struck by the lack of references to the Catapults in the Green Paper. (I found a single mention). I found this odd for two reasons. Firstly, their aim as stated on their website is to ‘help drive future economic growth’ chimes strongly with the Green Paper. Secondly, their geographical location would also seem to be a very practical illustration of what the current Government’s industrial strategy wants to achieve. Is it too soon to have any evidence of the regional impacts of the Catapult centres, I wonder?

Richard, excellent review, thank you. Two comments: a) This is an excellent point I have not seen before “the UK government is going to have get past its ingrained view that the people who work for research councils are back-office bureaucrats devoted to red-tape, whose numbers should be relentlessly pushed down. Instead, the high quality people in those roles need to be appreciated for their essential contribution to the success and cost-effectiveness of the projects they are responsible for.” From our experiences at EPSRC and BBSRC we know the capability of he people. There should be a real opportunity for redefining the jobs with the UKRI. b) I agree that whatever the rights and wrongs and ins and outs of spin-out numbers and deals, it’s not an order of magnitude issue. UK is doing great at this; tinkering with the structures may help a bit, but the only game changer will be more, patient capital – as demonstrated in huge increase (approx doubling) in spin-out creation from Oxford following OSI and its £500m. (The scale-up case is yet to be made or shown).

Best wishes Tom

Interesting read – thank you. You note that Industrial Strategies tend to favour incumbents. No surprise that some large sectors are gearing up for their slice of the cake now, when a few months ago they were very worried about impacts of Brexit. Is it not the case that this Industrial Strategy is something of a bribe to those sectors? On that note, and has been mentioned by your remarks and those of others: what will the UK ‘make’ which has end to end supply chains in the UK? Our connections with the EU are v difficult to unpick, at a time when the rules of engagement (and the means to ‘making stuff’) will become incredibly challenging. Finally, what of regional disparities and the voices of devolved administrations where innovation policy etc is a devolved matter? I’ve seen nothing in the consultation document about how to generate the level of effort which would undoubtedly be needed across the UK. Or is it the case that the devolved administrations are an after-thought in this process, begging the question of whether this is really about a centrist power grab under the steam of Brexit.

All very important questions! It’s difficult to imagine that the UK will be able to repatriate entire supply chains end-to-end, nor should it want to. Nor is it obvious that the nationwide institutions we’d need to develop strategy appropriate for the whole country, including the regions and devolved administrations, exist in a form adequate for the job.

Given the UK is an island nation with large potential for off-shore energy including wind, ocean and tidal, I was surprised not to see this mentioned in the strategy more clearly. Similarly, the only mention of ‘marine’ industry was exportable war ships. Where is the innovative thinking about reducing ocean-based pollution from shipping when 90% of what we consume (and probably what we sell) travels by marine freight? As Richard mentioned DARPA had a focus for generating innovation. It seems logical that a parallel focus for the UK in this day and age should be framed around innovation for clean and fair development — not growth — but development. If we took advantage of the tremendous synergistic cost savings available across many sectors (transport, health, green building), we could develop more effectively without so much costly growth. Figuring how to do this quickly would be highly exportable. But it requires looking beyond simply growth to the idea of development in human terms.