If you were a well-to-do Londoner in mid-to-late-18th century London, 1 shilling and sixpence would buy you a decent seat for a night out at the opera. Alternatively, if you were a London craftsman – a cutler or a tool-maker – the same money would allow you to buy in a kilogram of the finest Sheffield steel, made by Benjamin Huntsman’s revolutionary new crucible process. A reasonable estimate of inflation since 1770 or so would put the current value of one and six at about ten pounds. I don’t get to go out in London very much, and in any case opera is far from my favourite entertainment, but I strongly suspect that £10 today would barely buy you a gin and tonic in the Covent Garden bar, let alone a seat in that historic opera house. A hundred pounds might be more like it as a minimum for a night at the London opera now – and for that money you could buy not one, but a hundred kilograms of high quality tool-steel (though more likely from China than Sheffield).

This illustrates a phenomenon first identified by the economist William Baumol – in an economy in which one sector (typically some branch of manufacturing) sees rapid productivity gains, while another sector (typically a service sector – such as entertainment in this example) does not, then the product of the sector with low productivity will see an increase in its real price.

The reason for this is clear – the opera singers of today are no more productive in terms of arias per hour than their 18th century predecessors, but they are not going to sing for 18th century wages. They demand their share of the overall growth of the economy – a factor of 17 or so since 1760, as measured by real per capita GDP. And it is this growth which has been driven by technological advances like the ones that have so dramatically improved the productivity of steel manufacture. So the operation of the labour market works to raise the relative cost of the parts of the economy with lower productivity growth – and conversely, puts a lid on wages in those parts of the economy where productivity is growing fast.

Baumol’s insight was of profound significance, but it’s ended up with a very unfortunate name: the phenomenon is known as “Baumol’s cost disease”. It is as a disease that the phenomenon is most often interpreted; it leads to a relentless rise in the real cost of healthcare, education and the arts which, it is often concluded, will soon render them unaffordable. The point, though, is that the cost rises precisely because it is affordable – because it is the improvements in productivity in other parts of the economy that generate the increase in wealth that support those additional costs. Baumol’s mechanism isn’t a disease – it’s the crucial mechanism by which the unevenness of technological innovation is spread throughout the economy. It’s not a bug of modern capitalism, it’s a feature, and it would be better called something that reflects its positive character – “Baumol’s balancing mechanism”, perhaps.

Understanding this point illuminates some of the discussions that we have about the measurement of productivity – and its mis-measurement. Economists measure productivity in terms of money – they define labour productivity as the output produced per worker measured in constant pounds sterling of gross domestic product, not in terms of tonnes of steel or in the better education of our children. This is a reasonable thing to do at a given point in time, as it’s only the money value as revealed by a market that gives us any chance of comparing the incommensurable, of setting hours of opera against tonnes of steel.

But uneven technological progress means that the relative value of different goods and services change with time, and this leads to paradoxical results when we look at measured changes in productivity over the years. Even if some jobs showed no improvement at all in their productivity as measured by actual output, the real cost of those services would increase by Baumol’s mechanism, because wages in the sector would need to rise to track overall economic growth. Because of this, they would be producing an increasing contribution to GDP, and this would show up as an increase in their labour productivity in the economic statistics.

There is a flip-side to this phenomenon, of course. For something like steel, where technological progress has led to massive increases in the quantity and quality of the output for a given input, this is reflected in a substantial real-terms reduction in price together with a dramatic reduction in the number of people employed making it. The economic statistics would show this as an increase in labour productivity in this sector, together with a shrinkage of its overall share of the economy. But large though the measured productivity increase might be, it wouldn’t fully reflect the underlying technological improvement, some of whose fruits would, by Baumol’s balancing mechanism, have been redirected to the parts of the economy with slower productivity growth.

“A rising tide lifts all boats” was a saying often used by proponents of supply-side economics, and Baumol’s balancing mechanism tells us why we might hope this might be true. But experience tells us that the fruits of economic growth are not equitably shared out, and this inequality has been growing in recent years. For Baumol’s mechanism to work, one needs to have a properly functioning labour market that delivers fair outcomes (for some value of fair). But in reality, changing balances and imbalances of power play an enormous role; we’ve seen a shift in the share of output from labour to capital, and perhaps even more importantly, a disproportionate increase in the wages of the highest paid managers. In some sectors in which it isn’t obvious that underlying productivity has improved at all – financial services, for example – wage costs haven’t merely kept track of economic growth, but have substantially outpaced it.

Technological progress is always unbalanced – usually very unbalanced indeed. As I’ve frequently argued before, technology isn’t a single thing that goes forward at a steady rate. At any time, some technologies will be advancing very quickly, like information technology is now. Progress in other technologies will be slowing down – like pharmaceuticals – while yet other technologies can be stalled or even regressing. Economic growth is more balanced than the underlying technological innovation that drives it, because the Baumol mechanism redistributes the gains of the fastest progressing sectors across the whole economy.

The entire developed world seems currently to be having a productivity slow-down, which is at its most serious in the UK, so there’s some urgency in understanding the implications of this for innovation policy. Governments, correctly, realise they have to intervene to promote technological innovation; classical economics tells us that private sector actors alone will systematically underinvest in innovation because they cannot capture its full rewards. But where should the government make those interventions?

It might seem obvious that one ought to seek to promote innovation right across the economy. Currently about 78% of the UK economy is in the service sector, so this would imply much more attention on driving improvements there. In addition to the conventional support of research and development which are appropriate for sectors like manufacturing, there would need to be many more experiments with organisational change and modes of working in sectors where R&D is less appropriate.

But one also needs to be aware that growth is unbalanced. Looking at history, we see that productivity growth seems much easier to achieve in some sectors than others, so there’s an argument for concentrating support on those fast growing sectors (and relying on Baumol’s mechanism to spread the benefits across the wider economy).

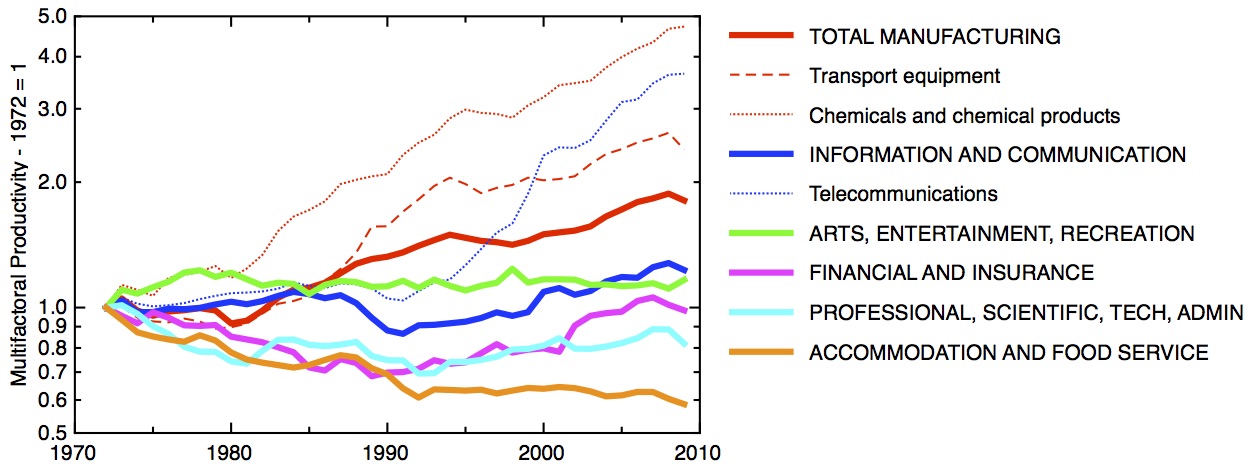

Multifactor productivity growth in selected UK sectors and subsectors since 1972. Data: EU KLEMS database, rebased to 1972=1.

My plot illustrates just how unbalanced growth has been in the UK over the last 35 years. The data – from the EU KLEMS database – shows multifactor productivity in various sectors and subsectors of the economy. Multifactor productivity (aka total factor productivity) is a measure of labour productivity corrected for different amounts of capital input – it is a measure of innovation in its broadest sense. This is an imperfect and theory-laden measure, but clear trends emerge.

At the level of sectors, one sees that manufacturing has risen steadily, while accommodation and food services has actually decreased. Other higher value sectors of the service economy – finance and insurance, and professional, technical and admin – have bounced around a little more, but show little net gain between 1972 and 2007. Of course, these are very broadly defined sectors, and within them there will be higher performing subsectors. At the level of the analysis here, the three best performers are two subsectors of manufacturing, chemicals and transport equipment, and the telecommunications subsector of ICT.

There’s an important argument against concentrating innovation support on the sectors that have demonstrated the greatest rate of innovation in the past, though. This is a backward looking strategy, which might fail to recognise the potential of new technologies or new business sectors. One could instead attempt to identify that sector or technology which was ripe for a period of very fast technological progress, and then concentrate support there. This approach of placing bets on future technological winners, anticipating very rapid progress in, say, quantum computing or synthetic biology, seems more forward looking. But our record of predicting future technology winners hasn’t always been brilliant, and this approach risks over-emphasising the novel at the expense of the incremental.

There is another strategy. This is to allow one’s innovation policies to be driven by entirely different state priorities than economic growth, and to trust to John Kay’s principle of obliquity to deliver productivity gains where-ever they happen to turn up. For all that this sounds unacceptably random, it’s probably not a bad description of what happened in the post-war period. Then “national security”, not economic growth, was the main motivation for innovation policy, and yet we ended up with what was probably the longest period of fast productivity growth the world has ever seen.