One positive feature of the Autumn Statement that the Chancellor of the Exchequer presented yesterday was that he gave unprecedented prominence to the UK’s serious productivity problem. What was less positive was that he had no analysis of where the problem comes from, and his proposed measures to address it are entirely inadequate.

This matters. Our ability to harness technological and other improvements to produce more value from the same inputs is the only fundamental driver for real wage increases; productivity growth drives living standards. And we rely on productivity growth to meet the future promises we’re making now – to grow our way out of our debts, and to pay for our future pensions.

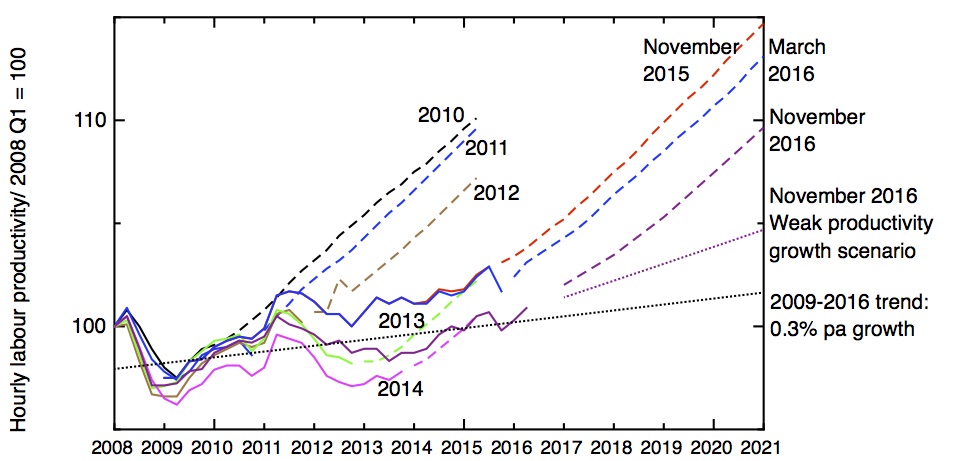

In 2007, productivity had been growing steadily at 2.2% a year since before 1970. That ended with the financial crisis; in the 7 years since it has barely risen at all. The government, and its independent forecasters, the Office of Budgetary Responsibility, have spent that time confidently expecting an upturn, a resumption of the pre-crisis growth rate. But that upturn has never arrived. My plot shows that history; this shows the successive OBR predictions for a resumption of productivity growth, together with the successive disappointing outcomes.

Labour productivity according to the successive Office of Budgetary Responsibility’s Economic and Fiscal Assessments for the years indicated, showing estimates of productivity up to the time of publication of each report (solid lines), and predictions for the future (dotted lines). Data for 2010-2014 from the October 2015 OBR Forecast Evaluation Report, for 2015 and March 2016 from the March 2016 OBR Economic and Fiscal Outlook, and November 2016 from the November 2016 OBR EFO.

After seven years of anomalously slow productivity growth, it’s time to face facts and acknowledge this isn’t an anomaly, it’s the new normal.

To be fair to the OBR, in their Autumn 2016 Economic and Financial Outlook, they have included a “weak productivity growth” scenario, projecting a rise in productivity of 0.8% a year, which results in the deficit rising again from 2020. Looking at the record of the last seven years, this looks far from the most pessimistic scenario one could imagine.

But if we don’t understand the causes of our productivity stagnation, we have no way of knowing when it’s likely to end. The OBR shrugs its shoulders, saying “since it is difficult to explain the abrupt fall and persistent weakness of productivity in recent years … it remains hard to judge when or if productivity growth will return to its historical average.”

My recent SPERI paper – Innovation, research and the UK’s productivity crisis – attempted to pick apart the causes of our productivity stagnation. Of course, there isn’t a single cause, but I focus on three issues – the end of North Sea oil, the wreckage caused by the bursting of our financial services bubble, and persistently low investment in R&D (especially by business).

There has been no material change in any of these factors. Production of North Sea oil is about one third of its 1999 peak value and continues to fall. The R&D intensity of the economy remains flat at best. Again, one can welcome the straightforward statement made by the Chancellor – “we do not invest enough in research, development and innovation”, and the additional government support for R&D he announced – rising to £2 billion by 2020-21, but this needs to be seen in the context of nearly a decade of flat cash budgets. And the relatively small infrastructure announcements need to be seen in the context of historically low levels of public capital investment.

And, of course, there is one big new factor – the prospect of the UK leaving the EU. If uncertainty about the terms of our departure and the loss of single market membership leads to a reduction in investment, that will reduce productivity even more. To focus specifically on R&D, we need to remember that more than half the business R&D carried out in the UK is done by foreign owned firms, and is thus particularly at risk of being relocated. In addition, the prospect of losing EU research funding risks offsetting much of the new government spending announced yesterday.

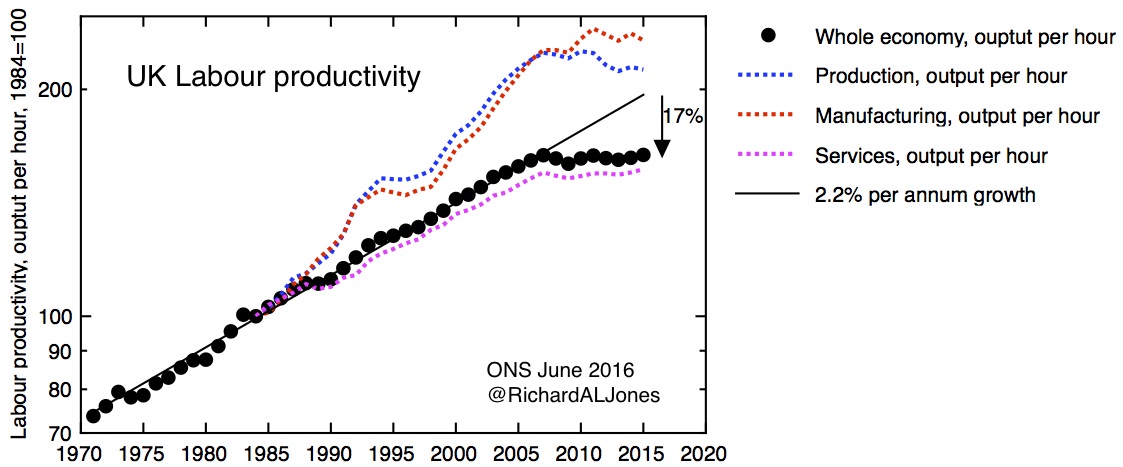

Labour productivity, rebased to 1984=100. Data: ONS Q2 2016 Labour Productivity bulletin.

Our current productivity stagnation, as my second graph stresses, is a phenomenon that is unique in most of our lifetimes. It’s positive that the government has begun to talk about it, even if that has to be dressed up in ritual incantations about the “fundamental strengths of the British economy”, and the remedies it proposes are unequal to the scale of the problem. Even if the government does develop a more serious plan to address the problem – perhaps in the promised “industrial strategy” – we need to recognise that results won’t be instantaneous, so it will be important to work out how to keep the social fabric of the country together while we adjust to the new reality of lower growth. More honesty about the real weaknesses of our economy is needed, and less of the self-delusion that seems to be so prevalent in our political classes at the moment.

Hi Richard,

We live in most probably the most overcrowded country outside of India. Therefore building Mega SuperStores, Mega Factories even extra Runways etc is more complicated compared to say France, Germany or USA. No Government can change this.

The best bet is to hope that the Fintech Hype can lead to an new enlightenment across the country via decentralization.