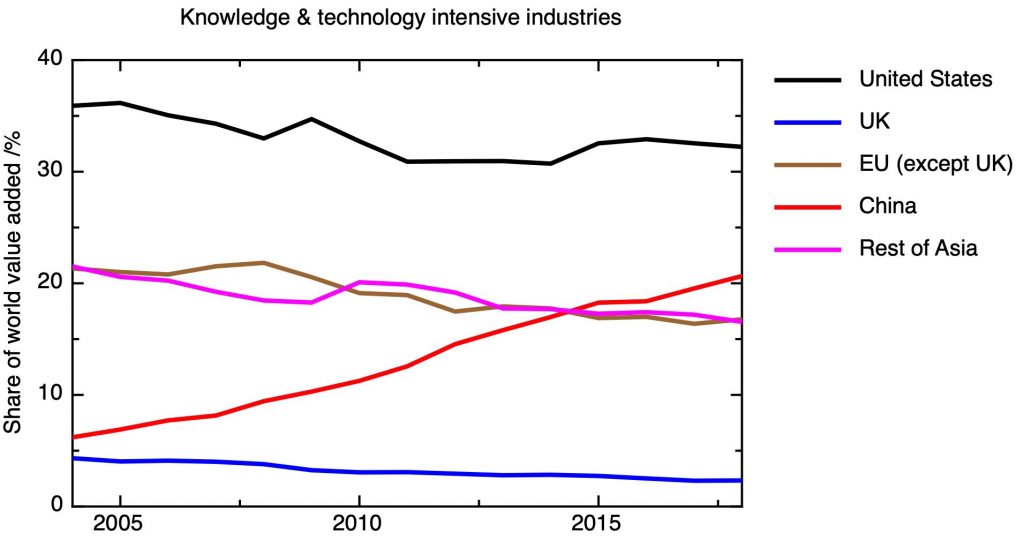

Now the UK has withdrawn from the European single market, it will need to rethink its current and potential future position in the world economy. Some helpful context is provided, perhaps, by some statistics summarising the value added from knowledge and technology intensive industries, taken from the latest edition of the USA’s National Science Board Science and Engineering Indicators 2020.

The plot shows the changing share of world value added in a set of knowledge & technology intensive industries, as defined by an OECD industry classification based on R&D intensity. This includes five high R&D intensive industries: aircraft; computer, electronic, and optical products; pharmaceuticals; scientific R&D services; and software publishing. It also includes eight medium-high R&D intensive industries: chemicals (excluding pharmaceuticals); electrical equipment; information technology (IT) services; machinery and equipment; medical and dental instruments; motor vehicles; railroad and other transportation; and weapons. It’s worth noting that, in addition to high value manufacturing sectors, it includes some knowledge intensive services. But it does exclude public knowledge intensive services in education and health care, and, in the private sector, financial services and those business services outside R&D and IT services.

From this plot we can see that the UK is a small but not completely negligible part of world advanced economy. This is perhaps a useful perspective from which to view some of the current talk of world-beating “global Britain”. The big story is the huge rise of China, and in this context, inevitable that the rest of the world’s share of the advanced economy has fallen. But the UK’s fall is larger than competitors (-46%, cf -19% for the USA and -13% for rest of EU).

The absolute share tells us about the UK’s overall relative importance in the world economy, and should be helpful in stressing the need, in developing industrial strategy, for some focus. Another perspective is provided if we normalise the figures by population, which give us a sense of the knowledge intensity of the economy, which might give a pointer to prospects for future productivity growth. The table shows a rank ordered list by country of value added in knowledge & technology intensive industries per head of population in 2002 and 2018. The values for Ireland & possibly Switzerland may be distorted by transfer pricing effects.

I’m a public finance specialist with an interest in the Government’s regionally focused levelling up agenda although my main field these days is international development. I’ve read with considerable interest your recent articles on the relatively low level of technological expertise in the UK and the challenges of reducing the global carbon footprint. I approached regional development by assuming that manufacturing was highly relevant to this initiative and that progress was likely to be dependent on the more advanced technologies. The green climate agenda is often cited by the PM as a major launch pad for a UK technology renaissance particularly with respect to levelling up the regions. Clearly this requires significant manufacturing competence if it is to be realised or we shall simply become a client state for other nations that have more relevant technological foundations (a point you make). Failure to make progress in this field would therefore restrict the UK’s economic potential, its technological standing and progress with regional development. This thinking led me to ask:

1. Do we not need to establish a closer working between universities and industry to develop commercial technological capacity, quite possibly supported by direct Government-backed investment and tax breaks, in order to increase the UK’s participation in new technology ventures? Specifically, would it be beneficial for the Government to encourage relevant university departments to work with industry in support of the practical application of knowledge and research to new technology ventures for which a dedicated funding stream would be made available? The Northern Powerhouse was supposed to make progress on this front but I have heard little about its successes and wonder whether Government backing was adequate for such a task.

Looking further at the various aspects of de-corbonisation seemed to beg questions about the interconnectedness of the sustainability agenda of which decorbonisation is an essential part, for instance:

2. (i) Does the current emphasis on EVs, wind technology and battery storage not lead to conflict with another aspect of sustainability, namely the depletion of relatively scare minerals and even within the decorbonisation agenda does this direction of travel threaten to cause a huge spike in energy requirements arising from extraction and smelting processes compounding the current challenge facing renewable energy (I think you touch on this too)? (ii) Does the burning of hydrogen not lead to global warming from the water vapour released thereby acting counter to the decorbonisation agenda? (iii) Are there not serious dangers arising from increased dependence on nuclear waste storage if fission technology remains dominant in the nuclear field and nuclear technology is positioned as the backstop to low-carbon energy provision?

I don’t want to question the low-carbon objective or the right of developing nations to achieve parity with the ‘west’ but I do wonder if part of the solution is to change modern human aspirations to some degree:

3. This may seem naïve but we are in a world of powerful mass interpersonal communication which could potentially influence human values worldwide. My initial target would be passenger transport and a significant swathe of freight transport. This would require a complimentary agenda of measured repatriation of production. A significant problem would then arise for some low income countries but it could be coupled with international efforts to upskill, diversify and protect essential trade with such nations (a task to be supported by the multiplicity of national and multilateral organisations in this field). President Trump advocated the repatriation idea in his America first policy that was largely aimed at rustbelt states but I am suggesting a different flag and would advocate more careful groundwork. Economists would say this suboptimises the global economy but the whole green agenda is one gigantic suboptimisation exercise balanced by a good deal of scientific guesswork (sorry about that). Some repatriation of production could also play into the regional development agenda and the growing concerns about strategic vulnerability exposed by the pandemic.

So I make two observations about low carbon policy development. Firstly, there is no overarching structure that I can see that puts all the possible initiatives, their consequences and deficiencies together in a reasoned assessment that underpins a feasible and desirable preferred direction of travel. There is just an imperative to do something as soon as possible and an inadequate shopping list of possibilities. No grand plan, no cost benefit analysis and almost no time left. The Glasgow conference could make a major contribution to these deficiencies by starting the debate about how the knowns and the know unknowns, quantifieds and unquantifides might be fitted together into a defensible outline prospectus for decision-taking. No doubt people are working on this and perhaps you are preparing a contribution.

Secondly, the UK’s contribution could include a commitment to actively engage in green technology development and roll-out. As you say, a search for partners must form an important aspect of this and it would be an interesting opportunity following Brexit. With the right guidance this could prove to be an improvement on the usual heroic commitments to meeting fairly unspecific targets within improbable timescales. This approach could even trail a policy of limited production repatriation to reduce freight transport.

This whole package could offer the UK a business development opportunity of real significance to the regional levelling up agenda. Investment vehicles and university support for industrial development of all kinds (both technological, and managerial) would help to make good the knowledge deficit. The policy could also include an appeal, based on the proceedings of the Glasgow conference, for voluntary limitations to international passenger travel to be supported by a worldwide campaign. Such a campaign could be well supported by businesses looking desperately for post C-19 cost cutting measures and virtual alternatives to business travel would do just that. The younger generations may well see sense in restricting holiday flights. The travel industry would be apoplectic but where are the ideas for quick, effective and painless solutions?

I’m sure this is highly naïve and largely irrelevant to you but it is an attempt to shape my own big picture and progress my thoughts on regional development. I very much look forward to reading your future thoughts on science and technology policy formulation.

Best regards

This is very sad!

Thank again for your analysis.

Zelah

My apologies for being so slow to moderate this comment. Lots of interesting reflections there.