Everyone now agrees that the UK has a serious problem of economic growth – or lack of it – even if opinions differ about its causes, and what we should do about it. Here I’d like to set out the scale of the problem with plots of the key data.

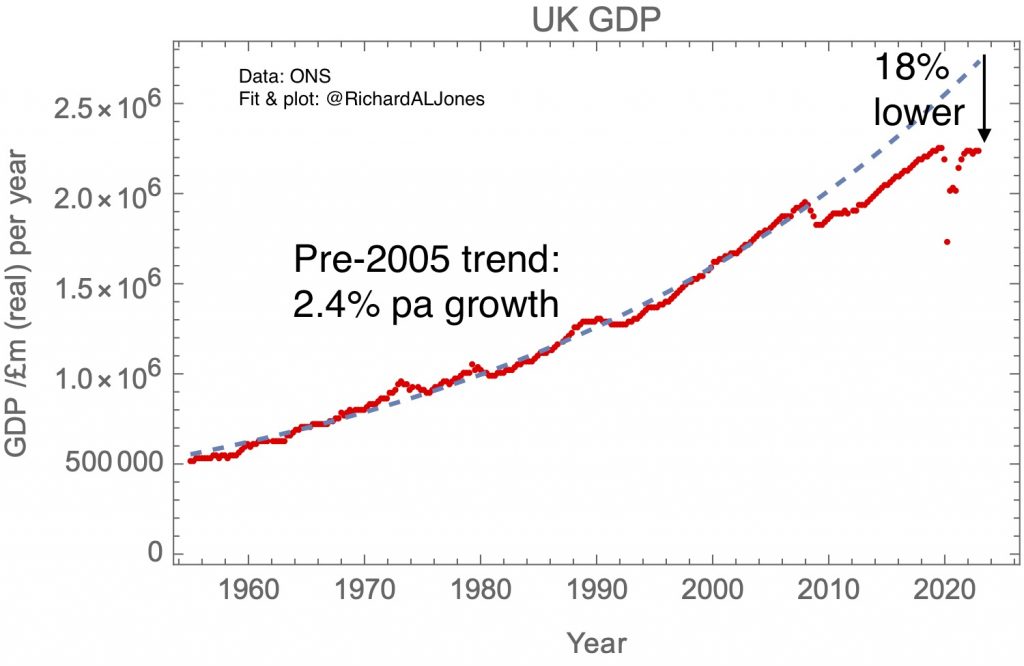

My first plot shows real GDP since 1955. The break in the curve at the global financial crisis around 2007 is obvious. Before 2007 there were booms and busts – but the whole curve is well fit by a trend line representing 2.4% a year real growth. But after the 2008 recession, there was no return to the trend line. Growth was further interrupted by the covid pandemic, and the recovery from the pandemic has been slow. The UK’s GDP is now about 18% lower than it would have been if the economy had returned to its pre-recession trend line.

UK real GDP. Chained volume measure, base year 2019. ONS: 30 June 2023 release.

Total GDP is of particular interest to HM Treasury, as it is the overall size of the economy that determines the sustainability of the national debt. But you can grow an economy by increasing the size of the population, and, from the point of view of the sustainability of public services and a wider sense of prosperity, GDP per capita is a better measure.

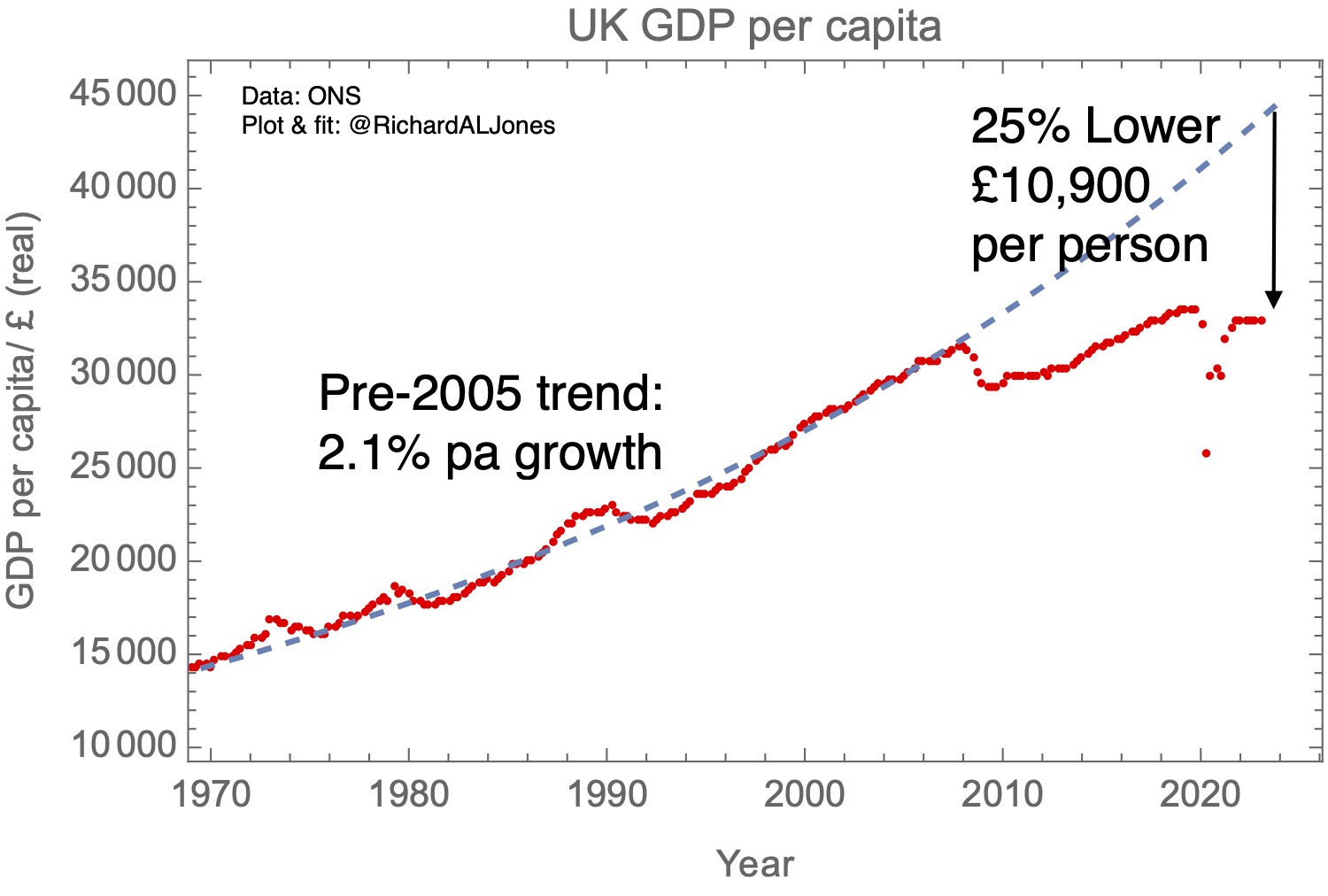

My second plot shows real GDP capita. GDP per person has risen less fast than total GDP, both before and after the global financial crisis, reflecting the fact that the UK’s population has been growing. Trend growth before the break was 2.1% per annum; once again, contrary to all previous experience in the post-war period, per capita GDP growth has never recovered to the pre-crisis trend line. The gap with the previous trend, 25%, or £10,900 per person, is perhaps the best measure of the UK’s lost prosperity.

UK real GDP per capita. Chained volume measure, base year 2019. ONS: 12 May 2023 release.

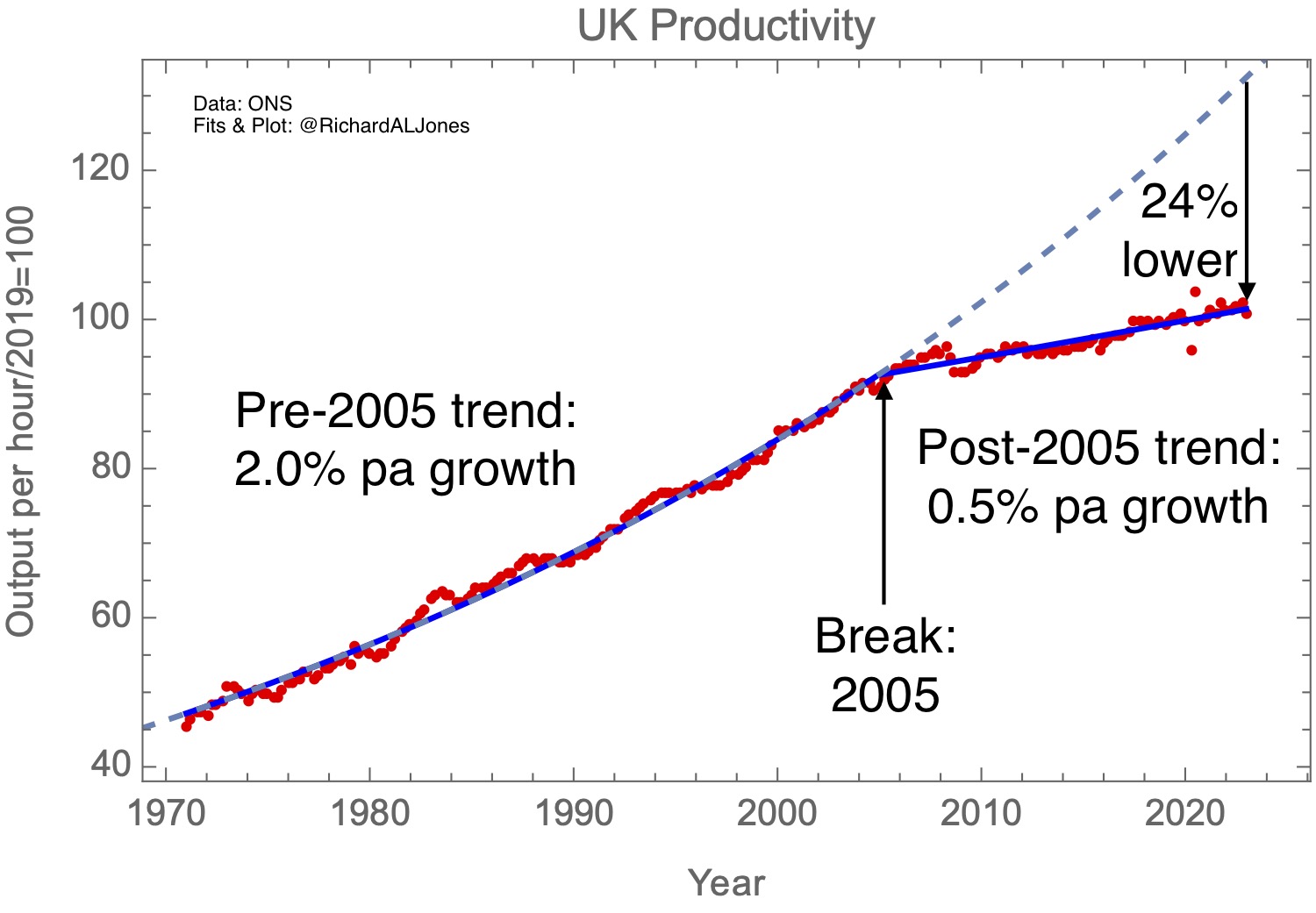

The most fundamental measure of the productive capacity of the economy is, perhaps, labour productivity, defined as the GDP per hour worked. One can make GDP per capita grow by people working more hours, or by having more people enter the labour market. In the late 2010s, this was a significant factor in the growth of GDP per capita, but since the pandemic this effect has gone into reverse, with more people leaving the labour market, often due to long-term ill-health.

My third plot shows UK labour productivity. This shows the fundamental and obvious break in productivity performance that, in my view, underlies pretty much everything that’s wrong with the UK’s economy – and indeed its politics. As I discussed in more detail in my previous post,“When did the UK’s productivity slowdown begin?”, I increasingly suspect that this break predates the financial crisis – and indeed that crisis is probably better thought as an effect, rather than a cause, of a more fundamental downward shift in the UK’s capacity to generate economic growth.

UK labour productivity, whole economy. Chained volume measure, index (2019=100). ONS: 7 July 2023 release.

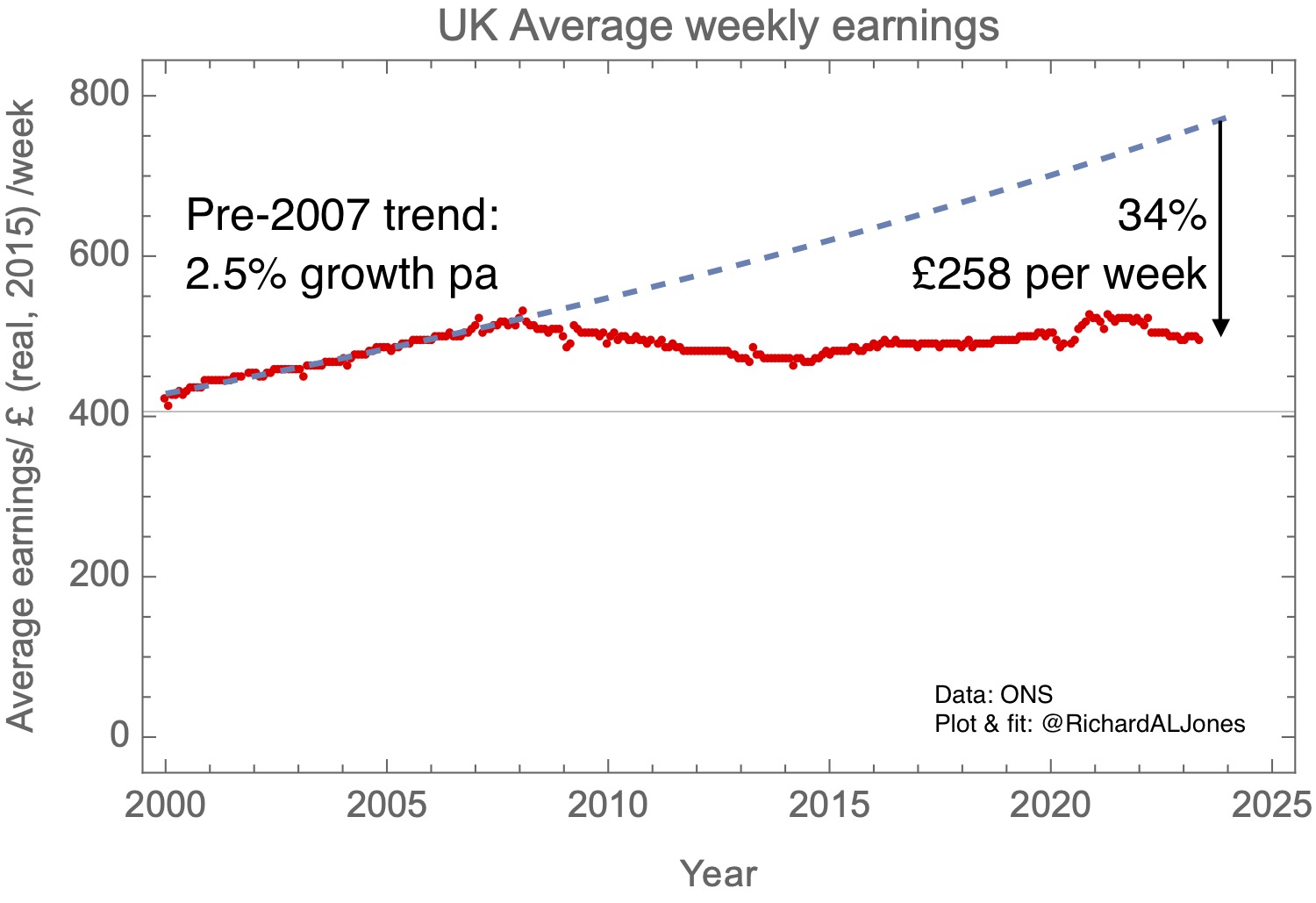

Talk of GDP growth and labour productivity may seem remote to many voters, but this economic stagnation has direct effects, not just on the affordability of public services, but on people’s wages. My final plot shows average weekly earnings, corrected for inflation. The picture is dismal – there has essentially been no rise in real wages for more than a decade. This, at root, is why the UK”s lack of economic growth is only going to grow in political salience.

UK Average weekly earnings, 2015 £s, corrected for inflation with CPI. ONS: 11 July 2023 release.

I’ve written a lot about the causes of the productivity slowdown and possible policy options to address it, reflecting my own perspectives on the importance of innovation and on redressing the UK’s regional economic imbalances. Here I just make two points.

On diagnosis, I think it’s really important to note the mid-2000s timing of the break in the productivity curve. Undoubtedly subsequent policy mistakes have made things worse, but I believe a fundamental analysis of the UK’s problems must recognise that the roots of the crisis go back a couple of decades.

On remedies, I think it should be obvious that if we carry on doing the same sorts of things in the same way, we can expect the same results. Token, sub-scale interventions will make no difference without a serious rethinking of the UK’s fundamental economic model.