This is the first of a series of three blogposts exploring the history of the UK’s nuclear programme. The pivot point of that programme was the decision, in the late 60’s, to choose, as the second generation of nuclear power plants, the UK’s home developed Advanced Gas Cooled Reactor (AGR) design, instead of a light water reactor design from the USA. This has been described as one of the worse decisions ever made by a UK government.

In this first post, I’ll explore the way the repercussions of this decision have influenced UK government thinking about large infrastructure projects. A second post will dig into the thinking that led up to the AGR decision. This will include a discussion of the basic physics that underlies nuclear reactor design, but it also needs to understand the historical context – and in particular, the way the deep relationship between the UK’s civil nuclear programme and the development of its indigenous nuclear weapons programme steered the trajectory of technology development. In a third post, I’ll consider how this historical legacy has influenced the UK’s stuttering efforts since 2008 to develop a new nuclear build programme, and try to draw some more general lessons.

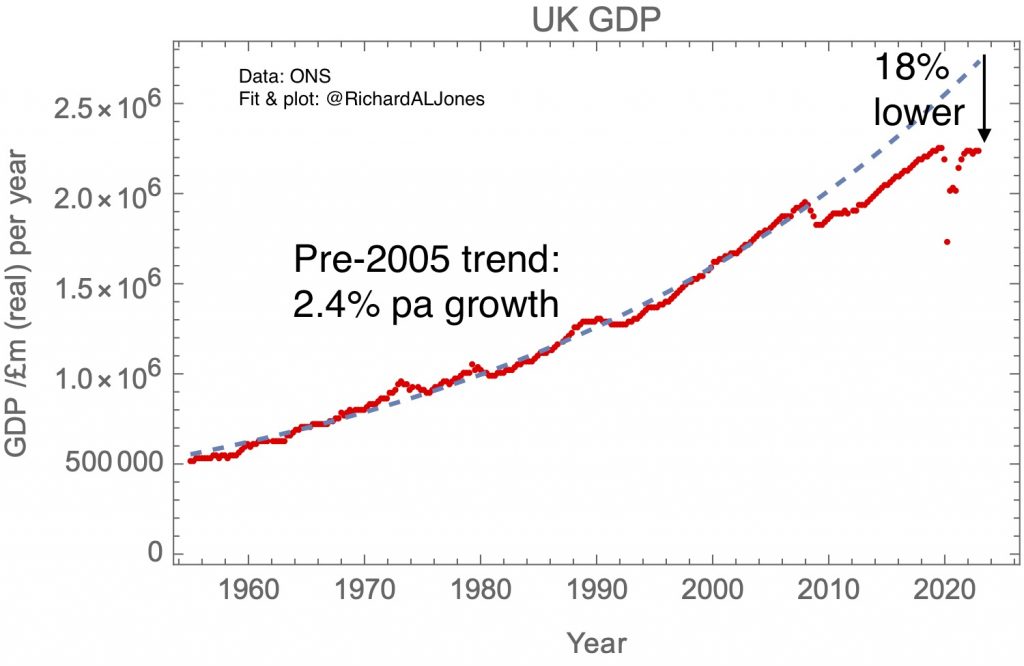

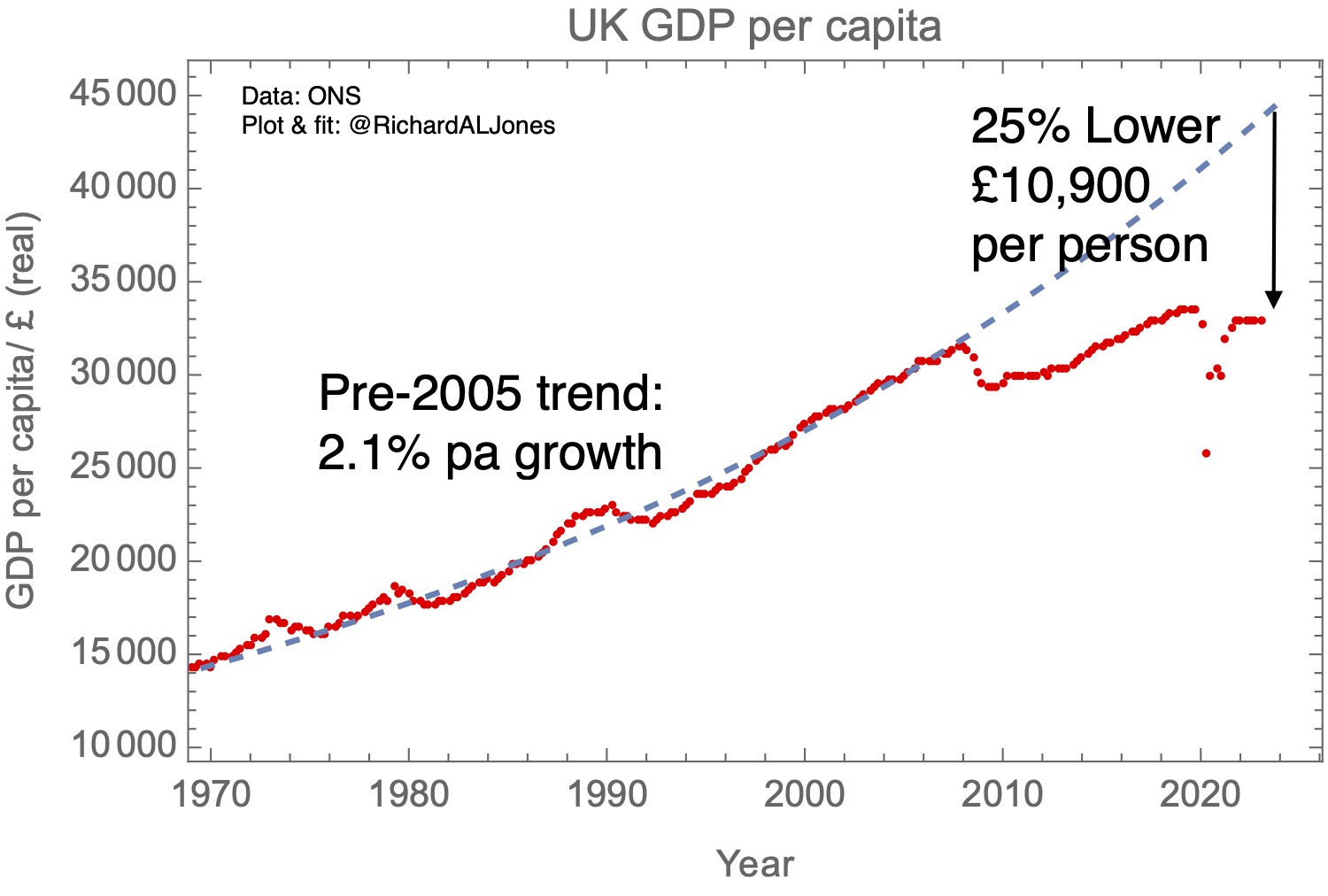

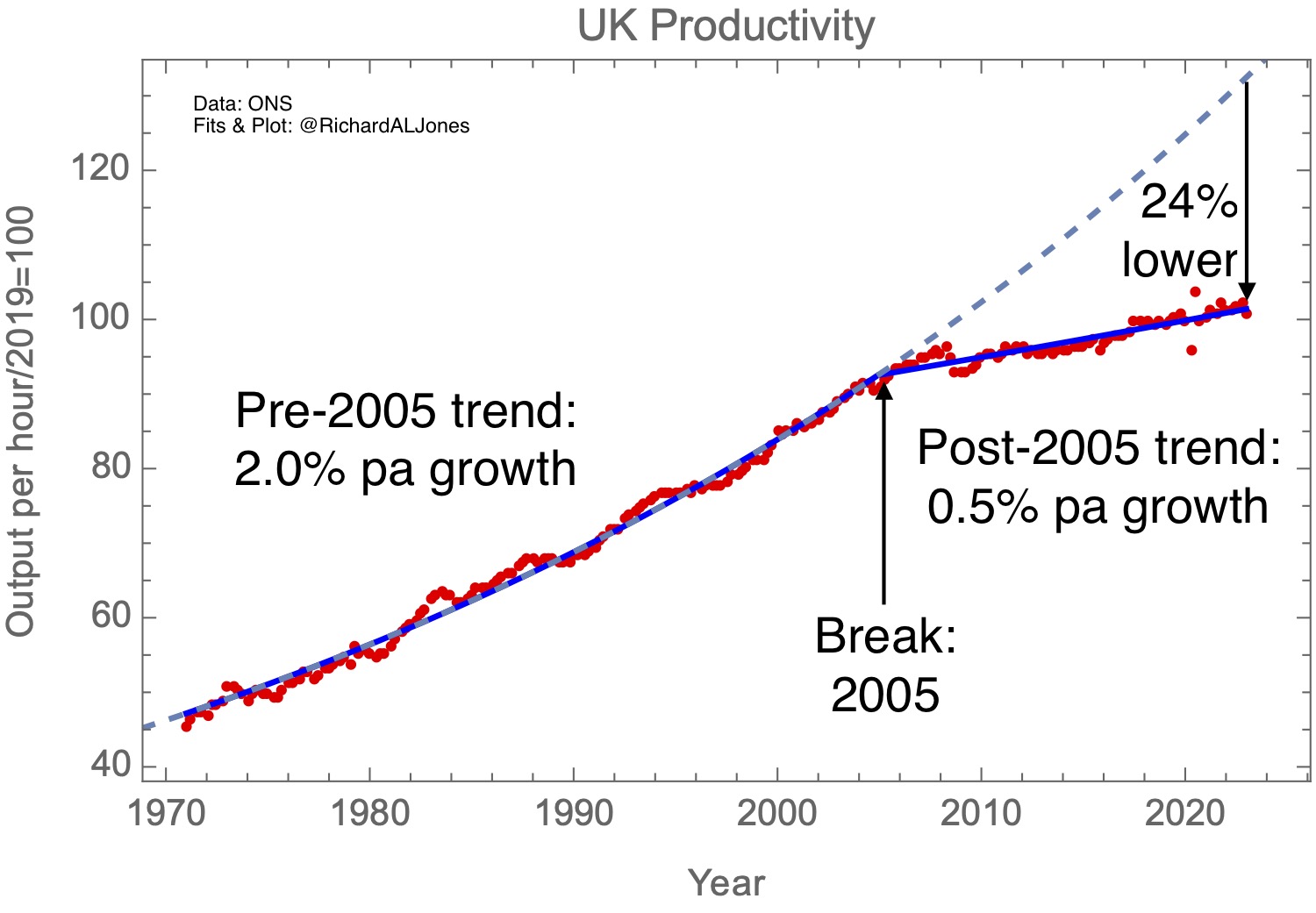

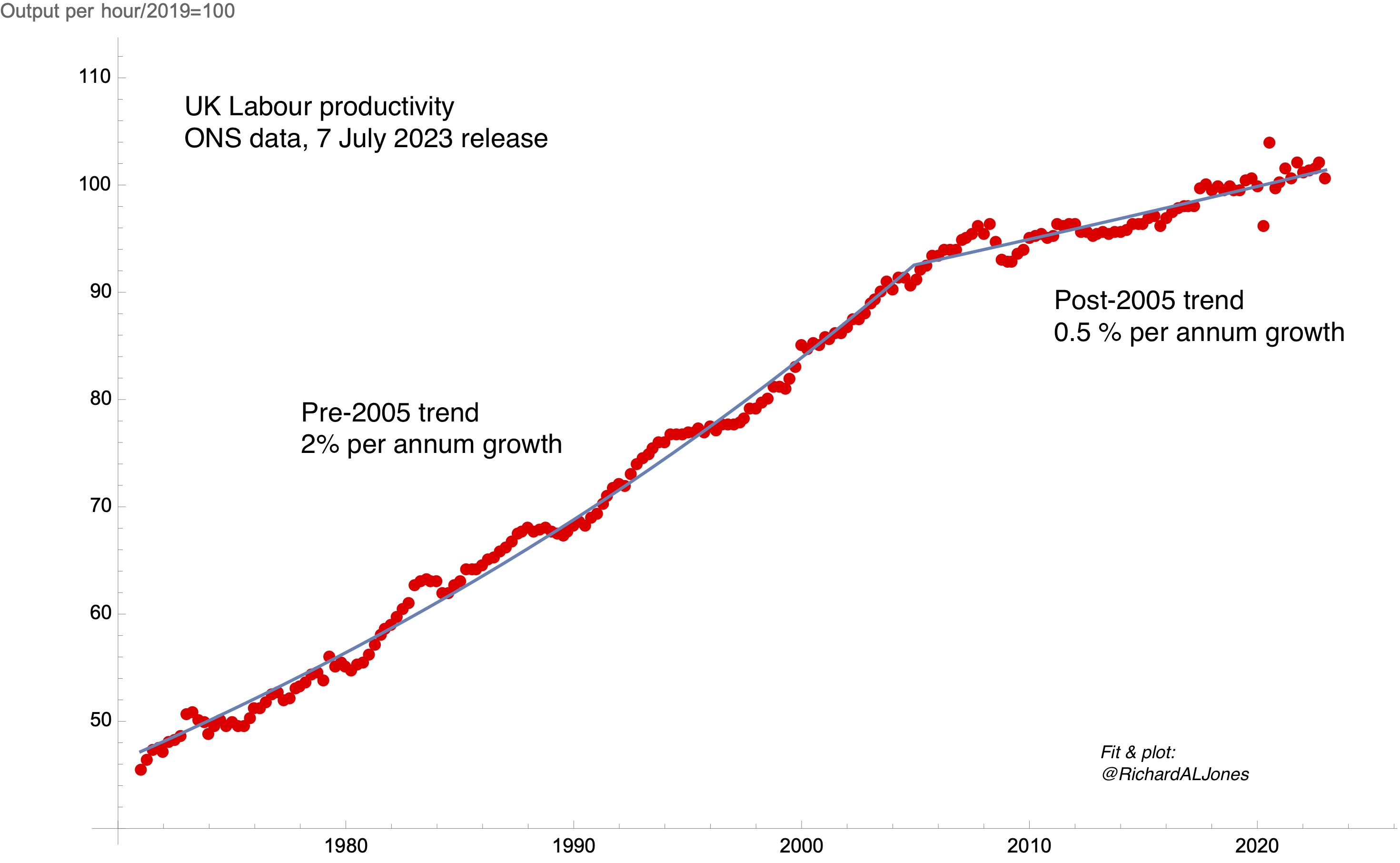

There’s now a wide consensus that a big part of the UK’s productivity problem stems from its seeming inability to build big infrastructure. At a panel discussion about the UK’s infrastructure at the annual conference of the Bennett Institute, former Number 10 advisor Giles Wilkes estimated that the UK now has a £500 bn accumulated underinvestment in infrastructure, and identified HM Treasury as a key part of the system that has led to this. He concluded with three assertions:

1. “Anything we can do, we can afford”. A saying attributed to Keynes, to emphasise that money isn’t really the problem here – it is the physical capacity, skills base and capital stock needed to build things that provides the limit on getting things done.

2. Why haven’t we got any White Elephants? On the contrary, projects that were widely believed to be White Elephants when they were proposed – like the Channel Tunnel and Crossrail – have turned out to be vital. As Giles says, HM Treasury is very good at stopping things, so perhaps the problem is that HMT’s morbid fear of funding “White Elephants” is what is blocking us from getting useful, even essential, projects built.

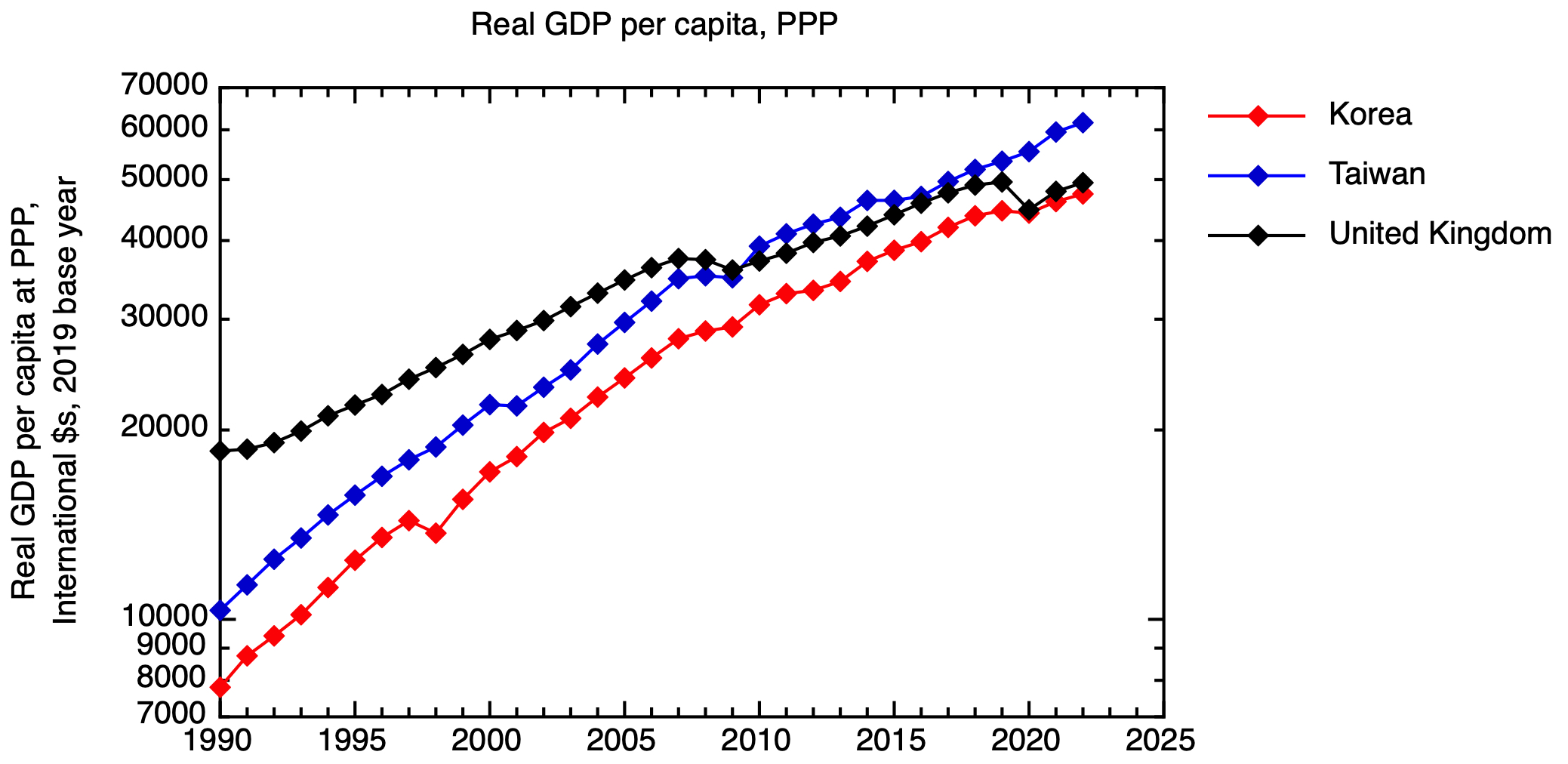

3. The UK needs to show some humility. We should take time to understand how countries like Spain and Italy manage to build infrastructure so much more cheaply (often through more statist approaches).

Where does HM Treasury’s morbid fear of White Elephant infrastructure projects come from? I suspect a highly influential 1977 article by David Henderson – Two British Errors: Their Probable Size and Some Possible Lessons – lies at the root of this. The two errors in question were the Anglo-French Concorde programme, to build a supersonic passenger aircraft, and the Advanced Gas-cooled Reactor (AGR) programme of nuclear power stations.

It’s now conventional wisdom to point to Concorde and the AGR programme as emblems of UK state technological hubris and the failure of the industrial policy of the 1960s and 70s. The shadow of this failure is a major cultural blockage for any kind of industrial strategy.

Concorde was unquestionably a commercial failure, retired in 2003. But the AGR fleet is still running; they produce about 60 TWh of non-intermittent, low carbon power; in 2019 their output was equal in scale to the entire installed wind power base. The AGR fleet is already well beyond the end of its design life; all will be retired by the end of the decade, likely before any nuclear new build comes on stream – we will miss them when they are gone.

The most expensive error by the UK state? The bar on that has been raised since 1977.

The AGR programme has been described as one of the most expensive errors made by the UK state, largely on the strength of Hendersons’s article. Henderson was writing in 1977, so it’s worth taking another look at the programme as it looks forty years on. How big an error was it? The building of the AGR fleet was undoubtedly very badly managed, with substantial delays and cost overruns. Henderson’s upper estimate of the total net loss to be ascribed to the AGR programme was £2.1 billion.

What is striking now about this sum is how small it is, in the context of the more of recent errors. In 2021 money, this would correspond to a bit less than £14bn. A fairer comparison perhaps would be to express it as a fraction of GDP – in these terms it would amount to about £30bn. A relevant recent comparator to this is the net cost to the UK of energy price support following the gas price spike that the Ukraine invasion caused – this was £38.3bn (net of energy windfall taxes, some of which were paid by EDF in respect of the profits produced by the AGR fleet). Failing to secure the UK’s energy security was arguably a bigger error than the AGR programme.

“No-one knows anything” – Henderson’s flawed counterfactual, and the actual way UK energy policy turned out

In making his 1977 estimate of the £2.1bn net loss to the UK from adopting the AGR programme, Henderson had to measure the programme against a counterfactual. At the time, the choices were, in effect, two-fold. The counterfactual Henderson used for his estimate of the excess cost of the AGR programme was of building out a series of light water reactors, importing US technology. Underneath this kind of estimate, then, is an implicit confidence about the limited number of paths down which the future will unfold. The actual future, however, does not tend to cooperate with this kind of assumption.

Just two years after Henderson’s paper, the global landscape for civil nuclear power dramatically changed. In 1979 a pressurised water reactor (a type of light water reactor) at Three Mile Island, in the USA, suffered a major loss of coolant accident. No-one was killed, but the unit was put permanently out of commission, and the clean-up costs have been estimated at about $1 billion. A much more serious accident happened in 1986, in Chernobyl, Ukraine, then in the Soviet Union. There was a loss of control in a reactor of a fundamentally different design to light water reactors, an RBMK, which led to an explosion and fire, which dispersed a substantial fraction of the radioactive core into the atmosphere. This resulted in 28 immediate deaths and a cloud of radioactive contamination which extended across the Soviet Union into Eastern Europe and Scandinavia, with measurable effects in the UK. I’ll discuss in the next post the features of these reactor designs that leave them vulnerable to these kind of accidents. These accidents led both to a significant loss of public trust in nuclear power, and a worldwide slowdown in the building of new nuclear power plants.

Despite Three Mile Island, having given up on the AGR programme, the UK government decided in 1980 to build a 1.2 GW pressurised water reactor of US design at Sizewell, in Suffolk. This came on line in 1995, after a three year public inquiry and an eight year building period, and at a price of £2 billion in 1987 prices. Henderson’s calculation of the cost of his counterfactual, where instead of building AGRs the UK had built light water reactors, was based on an estimate for the cost of light water reactors £132 per kW at 1973 prices, on which basis he would have expected Sizewell B to cost around £800m in 1987 prices. Nuclear cost and time overruns are not limited to AGRs!

Sizewell B was a first of a kind reactor, so one would expect subsequent reactors built to the same design to reduce in price, as supply chains were built up, skills were developed, and “learning by doing” effects took hold. But Sizewell B was also a last of a kind – no further reactors were built in the UK until Hinkley Point C, which is still under construction

The alternative to any kind of civil nuclear programme would be to further expand fossil fuel power generation – especially coal. It’s worth stressing here that there is a fundamental difference between the economics of generating electricity through fossil fuels and nuclear. In the case of nuclear power, there are very high capital costs (which include provision for decommissioning at the end of life), but the ongoing cost of running the plants and supplying nuclear fuel is relatively small. In contrast, fossil fuel power plants have lower initial capital costs, but a much higher exposure to the cost of fuel.

Henderson was writing at a time when the UK’s electricity supply was dominated by coal, which accounted for around three quarters of generation, with oil making a further significant contribution. The mid-seventies were a time of energy crisis, with seemingly inexorable rises in the cost of all fossil fuels. The biggest jump was in oil prices following the 1973 embargo, but the real price of coal was also on a seemingly inexorable rising trajectory. In these circumstances, the growth of nuclear power in some form seemed irrestistible.

Economics is not all that matters for energy policy – politics often takes precedence. Margaret Thatcher came to power in 1980, determined to control the power of the unions – and in particular, the National Union of Mineworkers. After her re-election in 1983, the run-down of UK coal mining led to the bitter events of the 1984-85 miners’ strike. Despite the fact that coal fired power plants still accounted for around 70% of generating capacity, the effects of the miners’ strike were mitigated by a conscious policy of stock-piling coal prior to the dispute, more generation from oil-fired power stations, and a significant ramp up in output from nuclear power plants. Thatcher was enthusiastic about nuclear power – as Dieter Helm writes, “Nuclear power, held a fascination for her: as a scientist, for its technical achievements; as an advocate for a strong defence policy; and, as an opponent of the miners, in the form of an insurance policy”. She anticipated a string of new pressurised water reactors to follow Sizewell B.

But Thatcher’s nuclear ambitions were in effect thwarted by her own Chancellor of the Exchequer, Nigel Lawson. Lawson’s enthusiasm for privatisation, and his conviction that energy was just another commodity, whose efficient supply was most effectively guaranteed by the private sector operating through market mechanisms, coincided with a period when fossil fuel prices were steadily falling. Going into the 1990’s, the combination of newly abundant North Sea gas and efficient combined cycle gas turbines launched the so-called “dash for gas”; in this decade natural gas’s share of electricity generation capacity had risen from 1.3% to nearly 30% in 2000. Low fossil fuel prices together with high interest rates made any new nuclear power generation look completely uneconomic.

Two new worries – the return of the energy security issue, and the growing salience of climate change

Two things changed this situation, leading policy makers to reconsider the case for nuclear power. Firstly, as was inevitable, the North Sea gas bonanza didn’t last for ever. UK gas production peaked in 2001, and by 2004 the UK was a net importer. Nonetheless, a worldwide gas market was opening up, due to a combination of the development of intercontinental pipelines (especially from Russia), and an expanding market in liquified natural gas carried by tanker from huge fields in, for example, the Middle East. But for a long time policy-makers were relaxed about this growing import dependency – the view was that “the world is awash with natural gas”. It was only the gas price spike, that begun in 2021 and was intensified by Russia’s invasion of Ukraine, that made energy security an urgent issue again.

More immediately, there was a growing recognition of the importance of climate change. The UK ratified the Kyoto Protocol in 2002, committing itself to binding reductions in the production of greenhouse gases. The UK’s Chief Scientific Advisor at the time, Sir David King, was particularly vocal in raising the profile of Climate Change. The UK’s rapid transition from coal to gas was helpful in reducing. overall emissions, but towards the end of the decade the role of nuclear energy was revisited, with a decision in principle to support nuclear new build in a 2008 White Paper.

We’re now 16 years on from that decision in principle to return to nuclear power, but the UK has still not completed a single new nuclear power reactor – a pair is under construction at Hinkley Point. I’ll return to the UK’s ill-starred nuclear new build program and its future prospects in my third post. But, next, I want to go back to the original decision to choose advanced gas cooled reactors. This has recently been revisited & analysed by Thomas Kelsey in When Missions Fail: Lessons in “High Technology” from post-war Britain

https://www.bsg.ox.ac.uk/sites/default/files/2023-12/BSG-WP–2023-056-When-Missions-Fail.pdf. His key lesson is that the decision making process was led by state engineers and technical experts. In my next post, I’ll discuss how design choices are influenced both by the constraints imposed by the physics of nuclear reactions, and by the history that underpinned a particular technological trajectory. In the UK’s case, that history was dominated – to a degree that was probably not publicly apparent at the time – by the UK’s decision to develop an independent nuclear weapons programme, and the huge resources that were devoted to that enterprise.