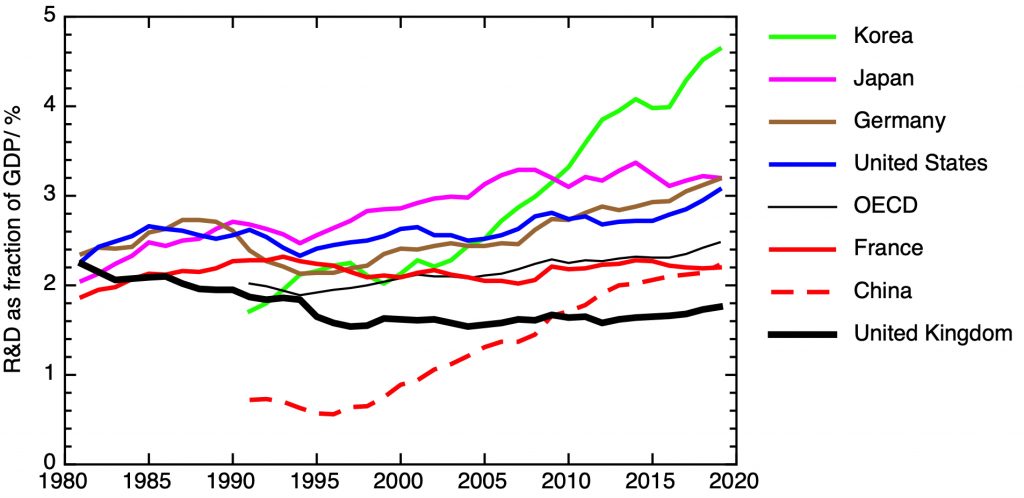

In the first part of this series attempting to sum up the issues facing UK science and innovation policy, I tried to set the context by laying out the wider challenges the UK government faces, asking what problems we need our science and innovation system to contribute to solving.

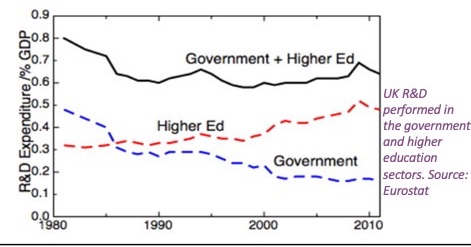

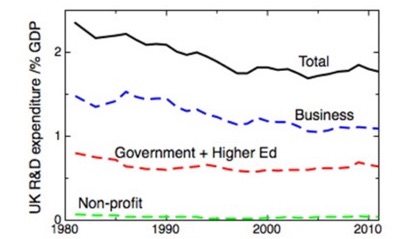

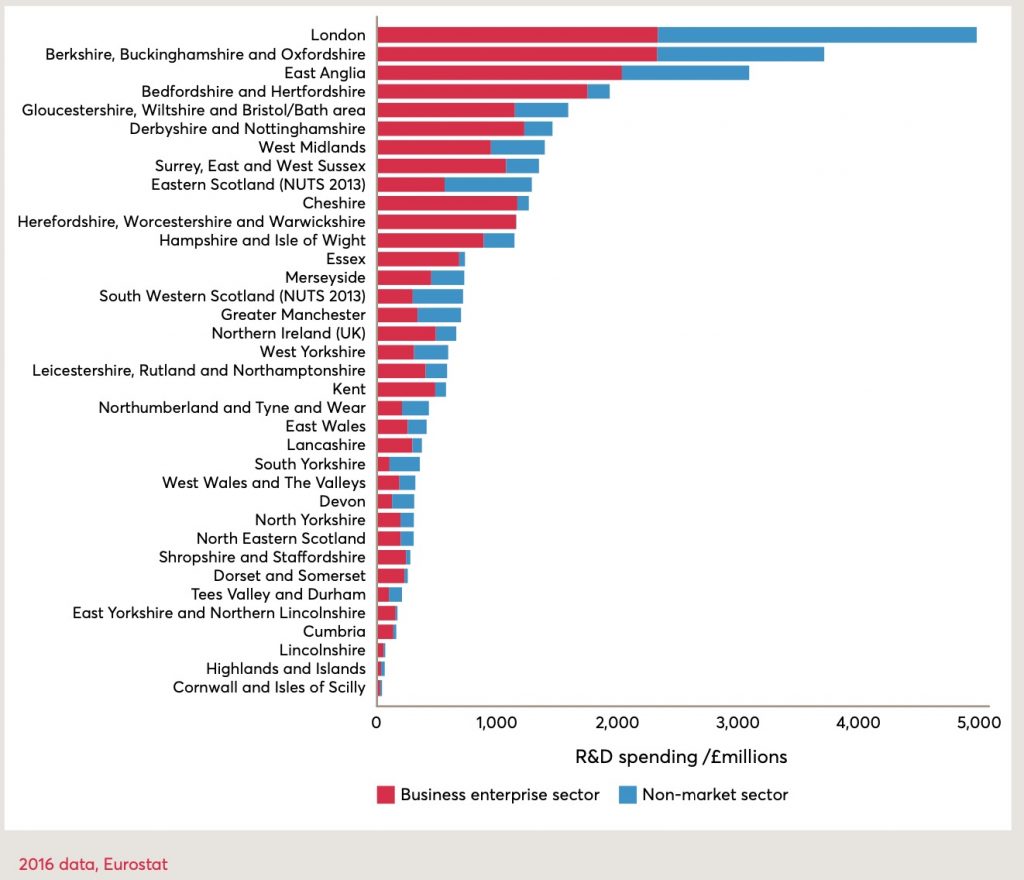

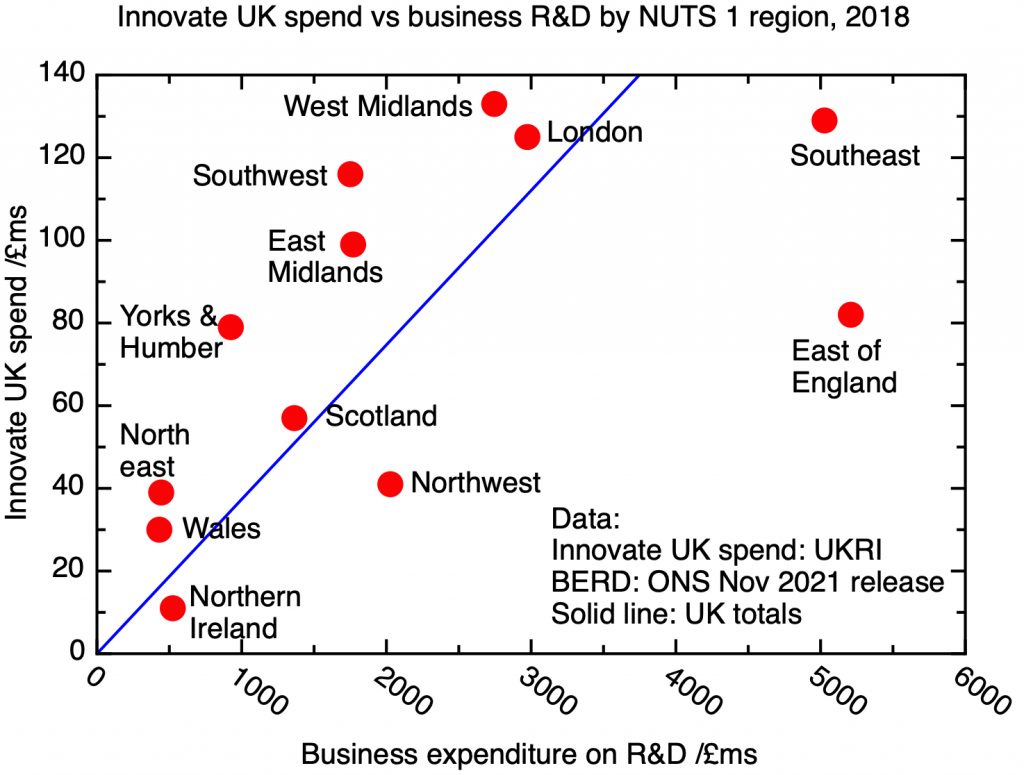

In the second part of the series, I posed some of the big questions about how the UK’s science and innovation system works, considering how R&D intensive the UK economy should be, the balance between basic and applied research, and the geographical distribution of R&D.

In this third part, I move on to a more detailed discussion of the institutional landscape of R&D in the UK. In the next part, I’ll move on to the funding system.

3.1 Who does R&D, and who pays for it?

It’s an obvious, but nonetheless important, point to note that there isn’t an exact match between who funds research and where it’s carried out. Business can pay for research in its own laboratories, but it can also sponsor research in universities. Likewise, some research done research done by private business is paid for by the government. R&D statistics differentiate between sector of performance and financing sectors. The overall funding flows for the UK are summarised in this excellent flow diagram, from the ONS.

Flows of research and development funding in the UK in 2019. From Gross domestic expenditure on research and development, UK: 2019, ONS.

I begin by reviewing the mix of different research institutions in the UK. In the next part, I’ll consider who pays for that research, and how that decisions about funding are made.

3.2 Where is R&D done in the UK? The institutional landscape

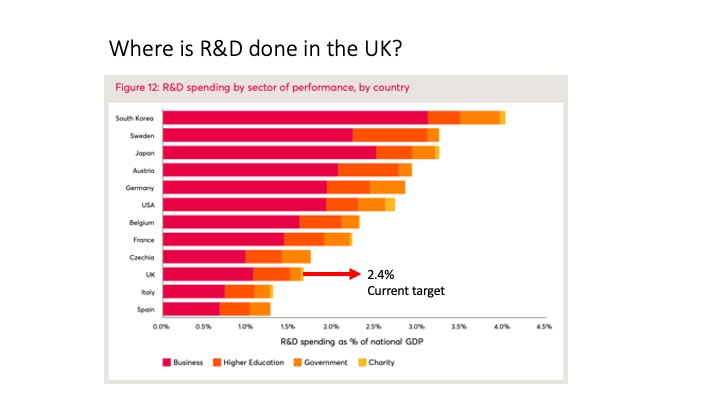

R&D can be carried out in a number of different kinds of institution with different missions – universities, government funded research institutes, charitable research institutes, and private sector laboratories run as part of profit-making enterprises. My next figure shows how the mix of R&D performing institutions in the UK compares with other countries.

International comparison of the breakdown of R&D spending by sector of performance. From The Missing Four Billion.

The UK stands out in two ways – one is its overall low R&D intensity, as discussed in the last section. Big increases in both public & private R&D are needed to meet the UK’s current R&D intensity target of 2.4%. But in addition to this overall low level of R&D, the UK is an international outlier in the degree to which non-business R&D is concentrated in universities, with a much lower proportion in non-university government laboratories.

The UK, Germany & USA all do similar amounts of R&D in universities, relative to the overall size of their economies. But Germany and the USA do much more R&D in government owned R&D institutes, which tend to focus more on applied and mission focused R&D. As discussed in the last section, this reflects a positive policy choice by UK governments to withdraw from this kind of research.

3.2. University research

The dominant role of universities in the UK’s public research system has positive and negative features, arising from the way university finance operates and the competitive pressures they operate under. As far as the government is concerned, they deliver research very cost-effectively, because they subsidise their research activities from other sources of income. Because the environment they operate in is very competitive, both nationally and internationally, they respond in a very focused way to the incentives and pressures that competition puts them under. Up to now, those incentives have largely favoured the production of academic science that is highly ranked by measures such as citations and recognition by international academic peers. Thus they do well in international league tables. But this doesn’t come without cost.

It’s important to understand that, in the UK, universities are independent corporate entities (usually regulated by charity law), not direct arms of the state. This is in contrast with, for example, universities in Germany, and state universities in the USA. They can own their own assets, and their employees are not civil servants. So (to the occasionally obvious annoyance of ministers), the government can’t directly tell them what to do. The government does, however, have great influence on them through the very substantial funding that they provide, and the regulatory framework they can impose.

There are more than 100 universities in the UK, but not all of them are strongly focused on research, and indeed research is very concentrated in a relatively small number of institutions. Just four institutions – Oxford, Cambridge, and the two large London universities, UCL and Imperial – account for nearly a third of all research contract funding. Adding to these a further 5 large civic universities takes the fraction to a half, while 80% of the funding goes to 27 institutions.

Where does the funding for a research intensive university come from? On the research side, there is a so-called “dual support” system, through which the university receives a block grant, which can be used at the university’s discretion, but which is linked to the amount and quality of research it does, as measured through the “Research Excellence Framework” (of which, more later). Then there are research grants and contracts, competitively awarded to pay for discrete research projects, from research councils, and to a lesser extent charities and businesses.

On the teaching side, there are some remaining block grants for subjects that are particularly expensive to teach (e.g. medicine), but the bulk of funding comes through student fees. For home students, these are paid for through the student loan scheme, where the upfront cost is paid by the government and (partially) recouped through income-contingent payments from graduates. The maximum tuition fee is set by the government at £9250. Fees for overseas students aren’t capped in this way, and are in effect set by the international market for higher education and the pricing power of individual institutions, which is naturally related to their reputations. To give one example, Imperial College currently is able to charge more than £30,000 per year for an undergraduate engineering degree. This is at the high end of the scale, but most UK research intensive universities will charge overseas students substantially more than double the home fee.

Finally, income from endowments, derived from philanthropic donations over the years, and income from licensing intellectual property, do make contributions to the finances of some institutions. In contrast to the situation in the USA, where many universities have multi-billion-dollar endowments, only in Oxford and Cambridge in the UK does this kind of other income make a material difference.

To summarise the financial situations of UK universities, teaching home students more or less breaks even (though there are variations by subject, and the position is worsening due to the freezing of the fee). Research loses money; overall the combination of the block grant and research grants covers perhaps 70-80% of the true costs. Teaching overseas students makes a substantial surplus, which is recycled into making up the losses on research. A justification for this situation is that it is the institution’s research that contributes to its international reputation, which in turn is what attracts international students and gives the institution its pricing power.

The order of magnitude of this cross-subsidy from international students is comparable to the total research block grant to universities. Thus we don’t have a “dual funding” system for research, it’s a triple funding system, where the government’s contribution to core costs of research is matched by the surplus from the fees of international students

The university research environment is shaped by the highly competitive world that they occupy, much of it by the design of successive UK governments. There is competition for home students, since the Coalition government removed central government controls on the total number of home students each institution can accept. The competition for international students is itself international; the Chinese students who comprise the majority of these customers can choose their country of destination, with the main competition coming from the USA and Australia.

In research, the competition is played out in the proxy medium of the various international university rankings. These statistically dubious aggregations of fundamentally incommensurable metrics are irresistible to trade journalists and university publicity departments, unignorable by managers and governing bodies, and undoubtedly influential in the perceptions of university quality by prospective students. Quantitative measures such as research income and citation data are combined with indicators such as number of papers published in so-called “top journals” and prizes awarded to faculty members, and the outcomes of reputation surveys. The choice of metrics and measures is itself an implicit definition of what in research is valued and what is not, and this in turn will influence the strategy and operations of those universities who seek to compete on these measures.

In the UK, the government-run assessment of research quality – the Research Excellence Framework – is more carefully constructed, with extensive peer review of the research outputs at the level of individual publications from each university. It is also much more expensive. From the government’s point of view, it provides some kind of assurance of the value for money of its investment in research, and because it is directly linked to the funding universities receive, it can be used as a lever to change the behaviour of institutions in directions the government wishes. For example, in the last two iterations of the scheme, the ”impact” of research – on business, through the formation of spin-outs, on policy, on health outcomes, etc – is measured and incentivised.

What has all this competition done? Much has been written about the positive and negative aspects of features of the landscape such as the Research Excellence Framework, and I haven’t space to summarise those arguments here. Suffice to say that it seems entirely plausible to me that any kind of metric-based assessment system will drive up performance in those aspects that are measured, while leading to relative neglect of those aspects that are not directly measured, even if in the long term this neglect will probably have a detrimental overall effect.

In UK universities I think you could point to a run-down of technical support for research, and a poor career structure for staff scientists, as examples of these kinds of negative consequences.

3.3. Basic research institutes

In many other countries, basic research is carried out not just in universities, but in specialised research institutes. For example, Germany has the government-funded Max Planck Institutes, while in the USA, the Janelia Research Campus, funded by the Howard Hughes Medical Institute’s $27 billion endowment, has many admirers. These have been much less important in the UK system, with the Medical Research Council’s Laboratory of Molecular Biology providing a rare example of a purely discovery research focused institution. But as we will see, there has been a recent move towards such institutes in the UK.

Central facilities, like the Rutherford Laboratory and the Diamond Light Source in Oxfordshire, represent slightly different type of non-University laboratory. These provide expensive large-scale scientific facilities that are used by university scientists on a shared-accesss basis to pursue their own research programmes. The largest facilities are too expensive even for a single nation, and the UK has shares in overseas facilities of this kind too – the neutron source ILL, and the synchrotron radiation facility ESRF, both in Grenoble, France, and perhaps most famously, the high energy physics laboratory CERN, in Geneva, Switzerland.

These laboratories do of course have staff scientists – and, although their purpose is primarily basic science, they concentrate substantial amounts of technological capability. This means that they do provide substantial economic spillovers in their locations. For example, the Harwell technology campus has developed around the Rutherford Appleton Laboratory and the Diamond Light Source, serving as the nucleus of a powerful tech cluster in rural Oxfordshire. Thus location choices for these facilities can have big implications for regional economic growth; in the case of the Diamond Light Source, the alternative location was at the Daresbury Laboratory, near Runcorn in the Northwest.

The last decade has seen the foundation of new, dedicated upstream R&D laboratories. The largest of these is the Francis Crick Institute in London, now the largest biomedical research establishment in Europe. Other new laboratories include the Rosalind Franklin Institute, on the Harwell Campus in Oxfordshire, the Alan Turing Institute in London, and the Henry Royce Institute at Manchester.

Is basic research better carried out in focused institutes, or in research universities? It’s important to distinguish factors that are specific to the funding environment from anything more fundamental. It’s certainly true that a researcher wholly focused on doing science in an institute, with the highest quality equipment and technical support, will achieve more than a university researcher with substantial teaching and administration duties and a poorer research infrastructure.

The difficulty for the UK, though, arises from the way it finances basic research. Universities can do basic research at a lower cost to the state because of the cross-subsidy from teaching overseas students. This cross-subsidy isn’t available to research institutes, so if they are financed on the same basis as universities they will not be financially sustainable.

The alternative would be to finance all research on the basis of what it actually costs; without unrealistic budget increases this would lead to a substantial reduction in the volume of research carried out in the UK. On the other hand, it would allow universities, if they chose, to reproduce many of the positive features of research institutes, such as better technical support and more stable career structures for staff scientists.

3.4. Public sector research establishments

The first state-run scientific establishment in England (predating the foundation of the United Kingdom) was the Royal Greenwich Observatory. At the time, astronomy was a science of strategic importance to the state. The projection of England’s naval power across the Atlantic, and then across the world, to underpin trade and colonialism, relied on accurate astronomical measurements for navigation. But state run scientific establishments whose purpose was applied science in support of the state’s strategic priorities took off on a larger scale in the late 19th and early 20th centuries, with the foundation of institutions such as the Meteorological Office, the Laboratory of the Government Chemist and the National Physical Laboratory. Such establishments flourished particularly in the cold war “Warfare State”.

While this sector of the research landscape is amongst the oldest, it has perhaps seen the most change and disruption in recent decades. With the move towards a smaller state, many of these institutions have been reorganised, some taken over by universities, some converted into “arms-length bodies”, some transferred into private sector management, some privatised outright. The result has been a public research sector that is smaller, more atomised, and less well connected to the strategic priorities of the state. As written in a government report commissioned by the Government Chief Scientific Advisor in 2019 (Realising our potential through science): “The wide range of Public Laboratories that are owned by government present a significant resource for government in the leadership of outstanding ‘directed’ R&D, but several decades of their devolution from central government have created obstacles to a more strategic deployment of this resource”.

Inevitably, defense has been one of the main motivations behind the public sector research establishments, so institutions like the Atomic Weapons Research Establishment are the quintessential Warfare State research laboratories. AWRE was merged into the Atom Weapons Establishment, which in 1989 was taken into private management. This partial privatisation was reversed in 2021.

I think many people would be surprised that such a core part of the deep state as nuclear weapons was contracted out to the private sector in this way, and it is probably fair to say that this isn’t the place to look for the biggest spillovers into the private sector. Other defence establishments have, however had a bigger influence on the wider economy. The Royal Signals and Radar Establishment, at Malvern, was important in the development of liquid crystal displays and semiconductor optoelectronics. RSRE was privatised, with other defence laboratories, in 2001 as the company Qinetiq. Qinetiq is now a publicly listed defence-focused contract R&D company.

In the post-war period, civil nuclear energy was another major driver of state funded strategic research. The UK Atomic Energy Authority, in the 1960’s, was a huge enterprise running the both the civil nuclear energy enterprise and the weapons programme. The weapons programme was split from the civil nuclear energy programme in 1973; with the privatisation of energy in the 1980’s and the completion of the last new nuclear power stations in the early 1990’s, UKAEA was split up; responsibility for the decommissioning of its old sites was given to the Nuclear Decommissioning Agency, much of the R&D expertise was privatised as AEA Ltd, a contract R&D organisation which went into administration in 2012. What was left was the nuclear fusion programme, which now forms the core activity of the remaining UKAEA, based in the Culham Laboratories in Oxfordshire.

In another area of government – the criminal justice system – the evolution of research and development in support of forensic science makes an interesting case study. The Home Office’s Central Research and Support Establishment at Aldermaston historically provided forensic services to police services and other government departments, as well as developing new technologies (for example, developing and implementing the DNA profiling techniques invented by Leicester University’s Sir Alec Jeffreys). This was converted first into an executive agency – the Forensic Science Service – in 1991, then into a government owned company. As a government owned company, the Forensic Science Service provided forensic services for a fee, in competition with commercial operators.

In this environment, it was unable to cover its costs, and in 2012 the government decided to wind it up totally. Forensic science support for the criminal justice system is now provided by private providers in a highly competitive market. Research and development – both to validate and develop existing methods, and to develop entirely new techniques – has suffered (see this Lords Select Committee report). The private providers operate on margins that are too thin to sustain any long-ranged research, while forensic science research in universities has received little public funding, possibly because it isn’t perceived as being at the cutting edge of academic science, as measured by citations and publication in the most prestigious journals.

Similar stories of atrophy, if not complete liquidation, could be told about government supported research in other areas, such as public health, agriculture and food. The common feature is research in areas that, while societally important, lack both academic glamour and lucrative business opportunities.

3.5. Business R&D

As was stressed in the last instalment, the majority of research and development happens in the private sector. To what extent can we think of business R&D as part of a national innovation landscape? As we saw, most business R&D is done by large, multinational companies – and as such is part of a multinational system. The international nature of the UK’s business R&D is underlined by the fact that around half of it is done by overseas owned companies.

The dominant R&D companies in the world are ICT companies from the USA, Korea and China, automobile companies from Germany and Japan, and pharmaceutical and biotech companies from USA, Switzerland, and Germany. Only two UK companies make it into the top 100 of world R&D companies – the pharmaceutical companies GSK and AstraZeneca.

Does this relative lack of UK owned companies in the top world tier of R&D performing companies matter? The fact that the UK is an attractive destination for overseas companies to open R&D facilities in is often cited as evidence of the strength of the UK’s innovation system. The worry is that these investments are footloose; the UK is competing for these investments with other countries, which might offer other advantages such as lower labour costs, or access to larger markets. On the other hand, when corporate strategies change and “rationalisations” are demanded, proximity to the head office often seems to be a factor favouring the survival of R&D facilities.

Of course, the R&D performed by overseas owned companies in the UK is important; it anchors in the UK wider high value economic activities, such as design and manufacturing, and it has wider spillovers in those innovation economies. In the West Midlands, for example, the auto company Jaguar Land Rover, a subsidiary of the Indian company Tata Motors, has a major R&D centre in Coventry.

At the opposite end of the spectrum to large multinational companies with the scale needed to sustain large, internal R&D efforts in support of their own business activities are firms that specialise in supplying R&D as a service to other companies, quite often as part of a wider package of knowledge intensive business services including design and consultancy. This sector accounted for about 6% of business R&D in 2020; David Connell and colleagues have persuasively argued that R&D service companies play a central role in successful innovation economies such as that around Cambridge.

3.6. The Catapult Centres

The most recent entry to the public R&D landscape are the “Catapult Centres” – translational R&D centres launched by the Coalition Government in response to the 2010 Hauser Review. This called for the establishment of centres to focus on applied R&D in emerging technology areas, on the explicit model of Germany’s Fraunhofer Institutes.

The idea was that these centres would combine publicly funded R&D and innovation programmes with contract research. This would include the development and scaling up of manufacturing processes, and the production of technology and application demonstrators. The intentions was that they would bridge a gap in a linear technology development process, conceptualised in terms of the notion of “technology readiness levels” introduced in the aerospace industry.

There are now nine Catapult Centres (though one, the High Value Manufacturing Catapult, incorporates seven geographically dispersed centres which each operate with a considerable degree of independence. There does seem to be a consensus that the Catapult Network has helped fill a gap in the UK’s RD&I landscape (though the scale of the network is still relatively small).

I believe there is still a lack of clarity about what their mission should be. Originally, this was defined as doing applied R&D in emerging new technology areas. There is a danger here, that they will end up competing with commercial contract R&D providers. There are some bad precedents here: one of the abiding sins of UK technology policy is to expect public R&D centres rapidly to become financially “self-sustaining”; the effect of this is in effect just to create another SME, rather than having a wider impact on the national and regional innovation system.

On the other hand, a number of the Catapult Centres have taken on a wider remit, developing human capital through vocational training, in manufacturing advisory services, and in various networking and sector development activities, even though this is not part of their core mission as originally defined.

Eoin O’Sullivan and I have argued that we should have institutions that take such a wider role in developing innovation capabilities through technology diffusion, skills development, and the building of absorptive capacity are important for developing the weaker innovation systems that characterise those parts of the UK that economically underperform. The Catapult Centres could take on this role, given a formal widening of their remit – and additional resources.

3.7. Taking a look at the whole institutional landscape for R&D

It should be clear that the UK’s institutional landscape for R&D is complex, and has undergone big structural changes over the last few decades. I don’t think the effect of these changes was thought through at the time they were initiated, and it isn’t obvious that the system we are left with is optimal given the expectations people have of science and innovation to deal with the problems I outlined in the first part of this series.

The government is currently conducting a review of this landscape, led by the Nobel Laureate Professor Sir Paul Nurse, Chief Executive and Director of the Francis Crick Institute. This should report in the very near future.

I hope the Nurse Review recognises that there are several different problems that need to be addressed here. These include:

- How best to do basic, discovery science

- How to get public sector research establishments working well to address cross-government priorities

- How to fill in the “missing middle” of applied research

- How to develop regional innovation systems to increase productivity in economically lagging regions

- How to support and grow private sector R&D

It’s a good moment for change, with many conventional wisdoms dissolving. Given the consensus that the UK’s R&D intensity needs to be substantially increased, it will be necessary both to expand and modify existing institutions and, perhaps, to create new ones. But we’ll need to think clearly about the balance of different kinds of institutions we have now, and how that needs to change to meet today’s challenges.